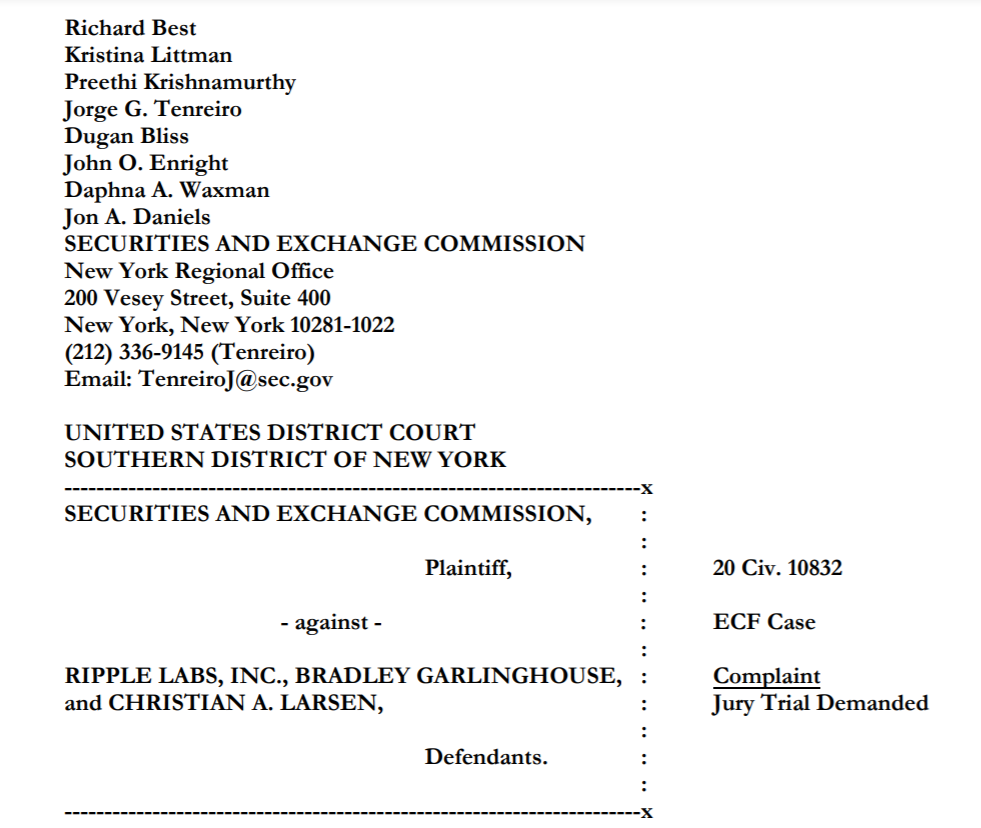

As the US Securities and Exchange Commission (SEC) sued Ripple Inc. and Ripple co-founders Brad Garlinghouse and Chris Larson, the industry is keen on the securities issue. The SEC allocated about 71 pages, the longest of all crypto-related prosecutions, to the lawsuit, arguing that XRP is a securities. It also added that Brad Garlinghouse CEO and Chairman Chris Larson have earned $600 million in private profits through the sale of XRP.

#”The defendant has sold over 14.6 billion XRP to date… The co-founders get $600 million in private profit.”

In its prosecution, the SEC first mentioned the defendants’ sales of XRP. According to the SEC, from at least 2013 to the time the prosecution was written, defendants had sold at least 14.6 billion XRP, an unregistered security. The sale of the XRP was made in exchange for cash or other assets, which is equivalent to about $1.38 billion in fiat currency.

Regarding this, the SEC said, “Ripple co-founders Brad Garlinghaus and Chris Larson did not submit a stock report during the XRP sales process, nor did they provide transparent sales information to investors. Instead, Ripple insiders continued to sell XRP on the market with opaque information. This is a case of violating Article 5 (a) and (c) of the Securities Act.”

Articles 5 (a) and (c) of the Securities Act are common provisions when the SEC sues unregistered securities. According to the provisions, if it is considered as securities, it is illegal to sell securities without a stock report. At this time, whether or not securities are identified is screened through the Howey test, which has been applied since 1946. The subtest consists of four things: ▲Investing in money ▲Investing in a common business ▲Expectation of return on investment ▲Investment in others’ efforts If all four items are true, it turns out to be securities. So far, there have been cases in which all major crypto projects (Centra, Telegram Ton, Kik, etc.) sued by the SEC for violating Article 5 (a) and (c) of the Securities Act have been lost. If you lose, you will no longer be able to handle coins by companies in the United States. In addition, fines are imposed in accordance with Article 20(d) of the Securities Act.

#“XRP has already been advised that it can be a securities, but it has been forced to sell”

Second, the SEC pointed out that the Ripple co-founders had already been forced to sell XRP even though they had already been advised by lawyers and others that XRP could become a securities. In this regard, he said, “In early 2012, it was revealed that we received legal advice that it could be regarded as an investment contract due to the structure of XRP.” The SEC said, “The Ripple co-founder ignored the advice and started selling XRP without registering a securities. Eventually, from a financial point of view, it raised at least $1.38 billion and achieved a strategic success. The magazine was not transparently disclosed,” he said.

#”XRP is not currency, it is securities… Most of Ripple’s business revenue is XRP sales”

Meanwhile, the SEC said that the reason XRP was viewed as securities, not currency, was because most of Ripple’s business profits were made through’sale’ of XRP. Although Ripple claimed to make business profits from ODL (formerly xRapid) services, the SEC explained that there was little profit from ODL services as a result of the investigation. In the process, XRP and Ripple said that there was no relationship, but he pointed out that most of Ripple’s revenue comes from XRP sales. The SEC’s position is that XRP cannot be viewed as currency even under the securities law.

In addition, the issue of paying XRP to partner companies that cooperated in the ODL service process without legal procedures was mentioned. In response, the SEC said, “Ripple has paid at least 324 million XRP to companies that have partnered with ODL services from December 2018 to July 2020. At this time, Ripple did not take measures to hold XRP to each company, and helped to sell XRP to the market.”

#”He said he was doing HODL while selling large quantities of XRP”

Finally, the SEC noted that Garlinghouse Ripple’s CEO (Chief Executive Officer) made a very optimistic statement on XRP prices in several interviews. In response, the SEC said, “In an interview with Bloomberg in December 2017, CEO Garlinghouse was very optimistic about the price of XRP. But at that point, he was already selling 67 million XRP.” In addition, in 2018, an interview was conducted saying that XRP was on the’HODL’ side. HODL is a coined word for US cryptocurrency investors, and it is similar to’Zonber’ in Korea. Incorporating these facts, the SEC sued the accused in violation of the Securities Law.

Parker’s note What is the future of XRP and other cryptocurrencies?

Since all major projects that have been sued by the SEC have been lost, distribution of XRP to Americans or the United States will not be easy in the future. This case is an ongoing trial independent of the resignation of SEC Chairman Jay Clayton or the inauguration of the Biden government. In the end, Ripple can secure long-term XRP fundamentals only if Ripple has a willingness to secure XRP usage in areas other than the United States and Americans, or if Ripple and XRP go separately as Ripple said. This year, Emi Yoshikawa, head of global operations for Ripple, told Joindie, “Ripple is a software company that exists independently of XRP. XRP is open source and decentralized.” However, even if XRP is independent, unlike other projects, XRP does not have a strong decentralized community base, and without Ripple’s actions, it is highly likely that XRP fundamentals will be greatly damaged. Considering these points and investor risk, it is noteworthy that the SEC will decide what to do. In a similar vein, XRP investors said, “Unlike Telegram Ton, XRP is already listed on several exchanges. In fact, if it is decided to violate the securities law, the damage to investors will be enormous, so the court cannot easily rule it.”

Meanwhile, this case is expected to be a major milestone in the criteria for determining cryptocurrency securities due to its scale. Although the ruling has not been issued yet, reading the prosecution can confirm that the decentralization between the operator and the coin is a key factor. Soon, any coin that does not secure decentralization with the operator can all enter the SEC’s radar. Even if the only channel in the operator’s business model is the token sale, it is expected to be subject to SEC sanctions.

Reporter Jo Indie Park Sanghyuk