According to the SEC, Ripple had already received legal advice in 2012 that XRP coins could be considered securities, but ignored them. This decision was made from a financial point of view. Over the next several years, at least $1.38 billion of coins were sold and used to fund the company’s operations, and Larsen and Garlinghaus also collected huge amounts of cash.

The SEC claimed that Larsen and Garlinghaus profited about $600 million from the sale of unregistered XRP. The sale of the coin took place as Garlinghouse repeatedly said it would “hold ripple for a very long time.” The SEC concluded that while Garlinghaus and Larsen were pulling out cash, they were driving investors in the wrong direction. They manipulated the price of XRP as a way to control the sale rate.

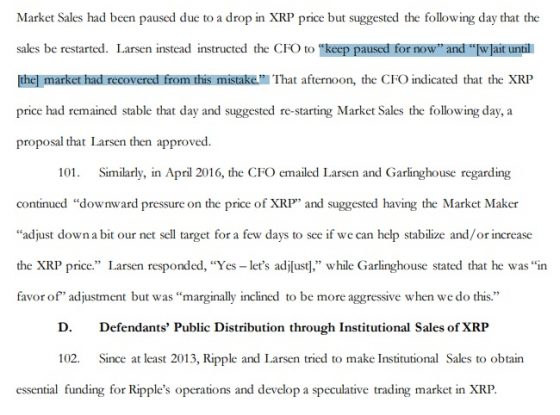

A complaint filed amended by the SEC This is what Lassen is instructing on adjusting the speed of the XRP sale.

According to the complaint, Ripple created a’information vacuum’, allowing the company and two insiders to sell coins. In fact, in 2015, one of Ripple’s market makers temporarily halted the sale of two-person-owned coins due to falling Ripple prices. Larsen instructed the market maker to “keep the sale off and wait for the mistake to recover.” The SEC said there were similar orders in 2016.

On the same day, the SEC revised the complaint against Ripple Labs and the two, and described the illegal acts of Garlinghaus and Larsen in more detail than before.