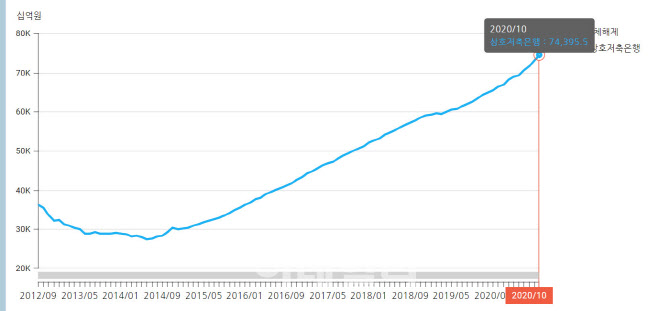

According to the Bank of Korea Economic Statistics System on the 27th, as of the end of October this year, the total balance of domestic savings bank loans was KRW 74,395.5 billion. This is an increase of 14.37% (9,3451 billion won) from the end of December last year (65,504 trillion won).

|

Savings bank loan growth, which was usually less than 1% (compared to the previous month), started to exceed 1% in February this year. The increase was steep, recording 2.49% in September.

Accordingly, the savings bank’s loan balance surpassed 60 trillion won in April last year and surpassed 70 trillion won in July this year. In October, after three months, it surpassed 74 trillion won and continued to increase rapidly. With this trend, the balance is expected to increase by about 10 trillion won this year alone.

The background of the surge in savings bank loans is the decline in their loan interest rates. According to the Korea Federation of Savings Banks, out of 68 savings banks that handle household mortgage loans in October, 23 were receiving interest rates of 15% or more per year.

Out of 35 savings banks that handle household credit loans, the average interest rate of all but one was below 20% per year. After the Bank of Korea’s benchmark interest rate cut, a series of declines in interest rates led to the savings bank loan interest rate cut.

In addition, there seems to be a ballooning effect that occurred when commercial banks’ mortgage loans and credit loans were regulated by the financial authorities. In fact, it is known that the balance of loans from the second financial sector increased sharply during the month of November.

On the other hand, some are concerned about the sharp increase in lending by savings banks. I am worried that it may act as a risk (anxiety factor) in the financial market.

In the financial stability report published on the 24th, the Bank of Korea said, “If the economic slowdown prolongs, the rapid increase in lending of savings banks can become a risk.” Diagnosed.