Input 2021.02.03 14:14

From the standpoint of new 2030 societies or workers who want to save pennies, it is good to invest in spare funds that will be used up and down if they are left alone, and from the perspective of banks, they can cover the younger generation as excellent financial consumers in the future. That’s right.

In foreign countries such as the U.S. and the U.K., change finance was already popular for several years. According to the Wall Street Journal (WSJ), American fintech company Acorns entered this field in 2012. Acons automatically saves less than the amount specified by the credit card user connected to the application (app).

For example, if a financial consumer sets the scrap amount to $1 and purchases a $19 item, fill in the scrap and pay $20 and save the remaining $1 instead. Depending on the level of service, Acons also charges a monthly fee of 1-3 dollars and automatically rolls the online shopping scrap. Since then, in foreign countries, similar companies such as Qapital, Revolut, and Qoins have sprung up.

For example, if you put 1,000 won in the first week, you put 2000 won in the second week and 3,000 won in the third week each week. If you pay steadily, you will receive coupons that you can actually use at regular intervals. In the first week, if you pay more than 30,000 won, you can get a coupon with a discount of 3,000 won. For parking 4·7·10·16·19, you will receive a 5,000 won discount coupon that can be used when paying more than 50,000 won.

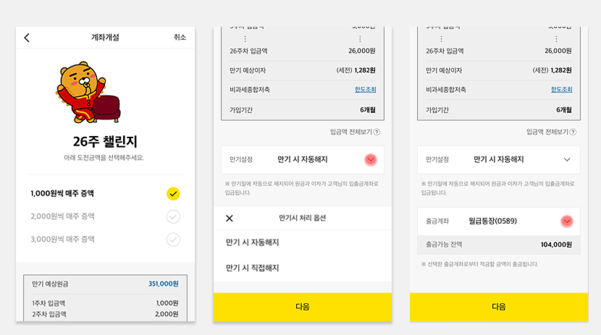

Last year, Kakao Bank partnered with retailers such as E-Mart and Market Curly to sell 26-week installment savings products, both of which quickly surpassed the 100,000 mark of popularity in the financial sector. The 26-week installment savings product released in partnership with E-Mart exceeded 100,000 units in a day, and 560,000 units scheduled in two weeks were sold. Market Curly also achieved the record number of new subscribers per day since its inception on the same day the product was released in December of last year.

On the 2nd, Yoon Ho-young, CEO of Kakao Bank, said, “We will present 26-week installments with more diverse partners this year.”

Commercial banks have also begun offering similar services to capture the young consumers who have become a major player in economic activity.

Recently, Shinhan Bank launched the’Sol XGS Million Won Challenge’ product with GS Retail for the new year. This small installment savings product has sold over 30,000 units within a month of launch. Shinhan Bank will give you a GS Fresh Mall gift certificate when you sign up for this product and collect over 1 million won. If you successfully complete the assignments given between the savings period, you can also receive a GS Retail coupon worth 24,000 won. Considering that after-tax interest is about 3,000 won when 1% of the 1% monthly compound interest is put in for 24 weeks (about 6 months), this is a considerable benefit.

Woori Bank also launched’Our 200 Day Savings’ in partnership with the popular Naver webtoon’Yumi’s Cells’ last year and sold out 100,000 copies earlier than expected. This product was popular with limited-edition character dolls, pouches, and mobile rings when a payment plan was made according to the economic situation.

Myeong-Hyun Jang, a researcher at the Credit Finance Research Institute, said, “In this era of ultra-low interest rates, banks are not limited to providing 1% savings rates, and at the same time, if you want to add products such as coupons, you need to find a suitable affiliate, and this effort leads to cost.” The reason for steadily releasing products is that the market value of consumers in 2030 is increasing in the aging financial market.”