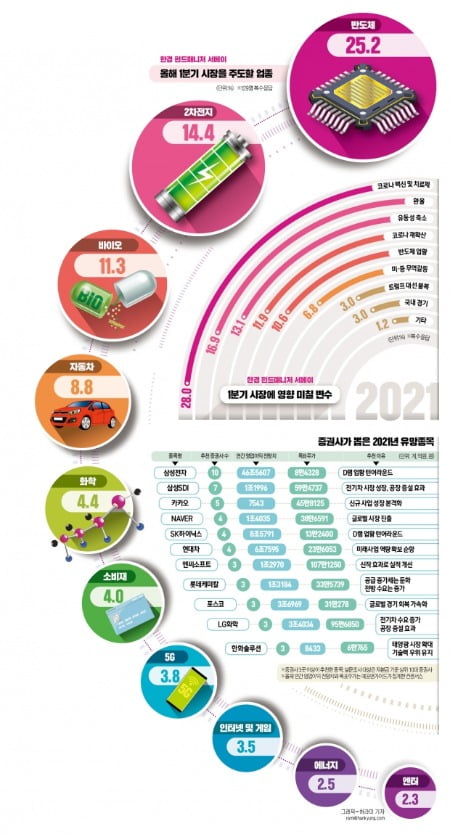

It was as expected. All of them were listed on the list of ‘2021 prospects’ selected by Samsung Electronics’ top 10 securities companies in Korea. This is because DRAM semiconductor industry conditions are expected to turn around in the first half of this year, and foundry (consigned semiconductor production) earnings are likely to improve. Samsung SDI was cited as a promising player in the secondary battery industry and Kakao in the internet industry.

Commonly selected items for Samsung Electronics and securities companies

In celebration of the new year, the Korea Economic Daily received recommendations for promising stocks this year from the top 10 domestic securities companies (based on capital). Samsung Electronics was the only stock listed as a prospect by all the securities companies surveyed. Samsung Electronics’ share price has risen sharply in recent years thanks to the prospect of a super cycle (super boom) coming to the semiconductor market. However, the view of semiconductor analysts is that there is still room for further upside. Lee Soo-bin, a researcher at Daishin Securities, said, “As DRAM semiconductor prices start to rise in the second quarter, Samsung Electronics’ market share is expected to expand.” “We are planning to make large-scale facility investments in the NAND flash market, so we can widen the gap with the second and third place. There will be.” SK Hynix, one of the domestic semiconductor’two-top’ stocks, was selected as a promising stock by four securities companies. Do-yeon Choi, a researcher at Shinhan Investment Corp. predicted, “As global semiconductor orders are increasing recently, SK Hynix’s share price will continue to rise until DRAM facilities are expanded.”

BBIG’s rising trend continues this year

There are 50 stocks that are included at least once among the top 10 securities companies. Of these, 18 stocks were picked up by two or more securities companies. Of these, nearly half of the BBIG (bio, battery, internet, and game) companies that stood out last year were eight. Among BBIG items, Samsung SDI, which makes electric vehicle batteries, received the most selection of seven securities companies. Following were Kakao (5), Naver (4), NCsoft and LG Chem (3 each), Samsung Biologics and Celltrion (2 each). “Samsung SDI will take aggressive orders this year,” said Kim Chul-joong, a researcher at Mirae Asset Daewoo. “The performance will improve rapidly in line with the expansion of the electric vehicle and energy storage system (ESS) market.” Hwang Seung-taek, a researcher at Hana Financial Investment, who voted Kakao as a promising stock, predicted that “Kakao’s new business, including Pay and Mobility, will grow in earnest this year.” NCsoft is also a promising stock. Three securities companies, including Meritz Securities, predicted NCsoft’s share price rise. Three to five large new games are expected to be released.

“Korean Air and others rebound due to the spread of vaccines”

Automobile-related stocks such as Hyundai Motor Company also stood out. There were four securities companies that ranked Hyundai Motor as a prospect. Hyundai Glovis and Hyundai Mobis, which are closely related to Hyundai Motor’s earnings, were selected as promising stocks by two securities companies, respectively. Samsung Securities researcher Lim Eun-young said, “Hyundai Motor plans to invest intensively in electric vehicles and autonomous driving technologies,” and said, “It will emerge as a company with core technologies for future cars.”

POSCO was the only company to be selected from two or more securities companies among the heavy-duty and long-term industries excluding automobiles. This is because steel prices are showing signs of a surge in global production recovery. Among the KOSDAQ stocks, Ecopro BM, a rechargeable battery material company, was the only one that received recommendations from two securities companies.

Among the stocks that suffered a major slump due to the Corona 19 incident, Korean Air and Hotel Shilla were selected as multiple recommended stocks. Korea Investment & Securities Research Institute Choi Woon said, “Until the normalization point, the aviation industry is inevitable for restructuring. This will be an opportunity for Korean Air to increase its market share and freight rates.”

Reporter Yang Byung-hoon [email protected]

Ⓒ Hankyung.com prohibits unauthorized reproduction and redistribution