|

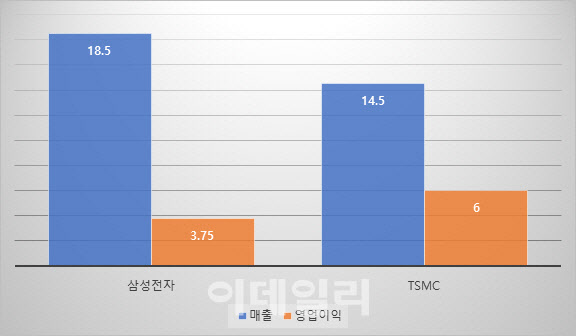

According to financial information companies F&Guide and TSMC on the 3rd, Samsung Electronics’ earnings concessions for the first quarter of this year, which were announced on the 7th, were sales of 60,805.8 billion won and operating profit of 8,834.4 billion won, respectively, 9.91% and 37.03, respectively It is expected to increase by %. Of these, the semiconductor business is expected to record 18 trillion won to 19 trillion won in sales and 3.5 trillion won to 4 trillion won in operating profit. Fixed transaction prices for memory semiconductors remained flat in the first quarter of this year despite rising spot prices, and the Austin plant was shut down for the first time since its completion in 1997 for more than a month.

In the case of TSMC, the guidance for the first quarter of this year, scheduled to be released on the 15th of this month, was presented with sales of 14.34 trillion to 14,68 trillion won and operating profit of 6 trillion won.

Citigroup predicted that TSMC’s January-February sales reached 65% of its guidance in the first quarter of this year, and monthly sales in March were the highest ever. In addition, it is analyzed that profitability will improve due to the high facility utilization rate and favorable exchange rate trend. TSMC’s 1Q operating margin is around 39.5%-41.5%.

TSMC recently announced an investment plan worth 100 billion dollars (approximately 113 trillion won) to expand semiconductor capacity (CAPA, production capacity). This is equivalent to the amount of 133 trillion won that Samsung Electronics previously decided to invest in for the number one system semiconductor by 2030.

However, from the second quarter of this year, Samsung Electronics is also expected to surpass 5 trillion won in operating profit in the semiconductor business thanks to the rising price of memory such as server DRAM. This is because memory fixed transaction prices, which remained flat in 1Q, are expected to turn upward from this month.

Kim Dong-won, a researcher at KB Securities, said, “The average fixed transaction price for DRAM in the second quarter is estimated to increase by 10% QoQ.” An upward reversal is expected in one year after the quarter,” he predicted.