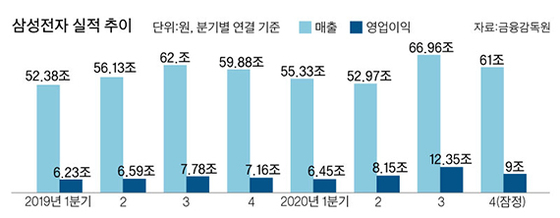

Samsung Electronics also smiled brightly at the new coronavirus infection (Corona 19) pandemic (a global pandemic). On the 8th, Samsung Electronics announced that it recorded sales of 61 trillion won and operating profit of 9 trillion won in the fourth quarter of last year as a result of aggregated provisional performance on a consolidated basis. It is a number that significantly exceeds the results of the fourth quarter of 2019 (the fourth quarter of 2019 sales were 59,880 billion won, and the operating profit was 7.16 trillion won). However, it was slightly lower than the stock price forecast (consensus). F&Guide, a financial information company, forecasts sales of 61,2876 billion won and operating profit of 9,543.8 billion won.

4Q sales 61 trillion, operating profit 9 trillion

Semiconductor is the top contributor, and home appliances are also good

Prospects for booming earnings this year are bright

Share price breaks to 88800 won

The KOSPI record high of 3152.18

Last year, Samsung Electronics’ annual sales amounted to 236 trillion won, an increase of 2.54% from 2019. The operating profit was 35.95 trillion won, up 29.46% from the previous year. The top contributor to improving performance is semiconductors. DRAM and NAND flash, which are memory semiconductors with Samsung Electronics taking the top in the world, led the performance. Last year, the total DRAM market sales amounted to 6,643 billion dollars (about 71.42 trillion won), an increase of 5% compared to 2019. The sales of NAND flash also increased by 23% from the previous year to 56.88 billion dollars (about 61.89 trillion won).

Graphic = Reporter Lee Jeong-kwon [email protected]

In the global market, Samsung Electronics has the highest share of memory semiconductors. The DRAM market share is 42%, and NAND flash also reaches 34%. Corona 19 benefited from the growth of the memory semiconductor market. Demand for products that require memory semiconductors such as laptops, smartphones, and servers is increasing due to the spread of telecommuting and the establishment of non-face-to-face infrastructure. In the field of 5G (5G) mobile communication and autonomous vehicles, demand for memory semiconductors is also increasing rapidly. Stock prices estimate that Samsung Electronics earned 50% of last year’s operating profit from semiconductors.

As people spend more time at home, the home appliance sector such as TV also improved. Operating profit is expected to reach KRW 1 trillion in 4Q. It is estimated that the IT and mobile (IM) divisions, such as smartphones, also generated operating profits of 2 trillion won in 4Q alone. Stock prices are expected to have shipped 60 million smartphones in the fourth quarter alone. However, some analysis suggests that earnings may have slowed somewhat due to an increase in marketing expenses at the end of the year. The final results by division are scheduled to be announced at the end of this month.

According to the news of earnings improvement, the share price of Samsung Electronics rose 7.12% to 88800 won. Based on the closing price, it is the highest level ever. On this day, the KOSPI also ended at an all-time high of 3152.18.

Samsung Electronics’ earnings outlook for this year is also good. Omdia, a semiconductor and market research company, predicts that sales in the global DRAM and NAND flash markets will increase by 23% and 14%, respectively, from last year. Research Fellow Joo-wan Lee of POSCO Research Institute predicted, “There is concern about oversupply, but in terms of quantitative scale, it will be able to exceed 2018, which is considered the biggest boom.”

Reporter Choi Hyun-joo [email protected]