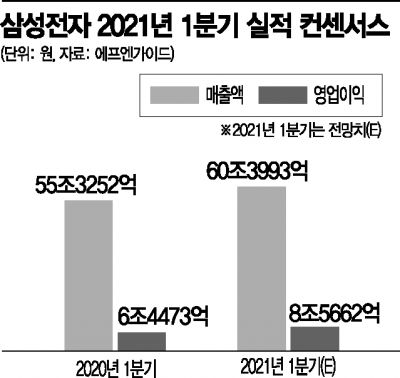

The sales consensus for the first quarter will exceed 60 trillion won

Even with Austin shutdown… 9% increase over the previous year

Mobile and home appliances play the role of filial piety

Semiconductor short-term losses are inevitable

[아시아경제 우수연 기자]Short-term losses are inevitable due to the shutdown of Samsung Electronics at the Austin foundry plant in the US, but it is expected to achieve solid results in the first quarter of this year. This is because the mobile and home appliance divisions are expected to drive earnings and offset the semiconductor division’s sluggishness.

According to FN Guide on the 15th

Samsung

Samsung

005930

|

Kospi

Securities Information

Present price

82,300

Compared to the previous day

500

Fluctuation rate

-0.60%

Volume

6,300,718

Full-time

82,800

2021.03.15 11:43 intraday (20 minutes delay)

Related Articles

Samsung Electronics’ stock price -0.6%…. On the last 5 days, institutional 4.29 million 956 shares net selling course’Honjo’.. Repeated fluctuations even in personal net buying. Samsung started public loans for college graduates in the first half of the year… Application deadline on the 22nd

close

The sales consensus for the first quarter of this year is estimated at 60,399.3 billion won in sales and 8,5662 trillion won in operating profit. This is an increase in sales by 9.1% and operating profit by 32.8% compared to the same period last year. Most securities firms lowered their earnings in the semiconductor division by reflecting the shutdown of their Austin plant in their earnings, but it was found that they raised their earnings in the mobile, IT, and home appliance display divisions.

卝蹂몃-nat

In particular, in the mobile segment, smartphone shipments are expected to increase by more than 20% compared to the previous quarter due to the launch of the latest game’Galaxy S21′, and the average selling price (ASP) is also expected to rise. In addition, the home appliance division, which enjoyed a boom along with growth in non-face-to-face demand last year, is expected to achieve record-high performance in the first quarter of this year thanks to a stronger portion of premium lineup sales. Kim Dong-won, a researcher at KB Securities, said, “The TV, home appliance, and PC markets are expected to enter a structural growth phase this year with replacement demand, rather than temporary growth last year due to non-face-to-face demand.”

In the case of the semiconductor division, where short-term losses are inevitable in 1Q, sales loss of 300 to 400 billion won is expected due to shutdown of the Austin plant. It has been more than a month since the Austin plant, which had disrupted production due to power problems from the 16th of last month, has been shut down. Power supply resumes at the end of February, and some lines are known to have started operating from early March, but it seems that it will take more time to fully restart. The industry expects to unveil the concrete plans to restart the Austin plant through Q&A with shareholders at the Samsung Electronics shareholders’ meeting scheduled for the 17th.

Meanwhile, as semiconductor factories around the world have stopped due to natural disasters such as the earthquake in Japan and drought in Taiwan, as well as the cold wave in the US, the effect of the shortage of semiconductor supply is spreading to the entire global manufacturing industry. As semiconductors for smartphones and PCs, as well as automotive semiconductors, are shortages, the set (finished product) production disruption is gradually becoming a reality. Market research firm Trend Force predicted that global smartphone production in the second quarter of this year will decrease by 5% compared to the previous year due to the shutdown of the Samsung Austin plant.

However, the industry predicts that the rise in semiconductor prices due to supply shortages will offset the decline in shipments and the semiconductor industry’s profitability will remain solid. Recently, foundry and fabless companies such as TSMC in Taiwan and Qualcomm in the U.S. are known to increase product prices by 15-20%, and PMICs (power management semiconductors) installed in smartphones and home appliances have already jumped by about 20%.

Doh Hyun-woo, a researcher at NH Investment & Securities, said, “There are concerns that the rise in semiconductor prices will lead to sluggish manufacturing of set makers and worsening profitability, and that it will have a negative impact on the overall IT industry. In most cases,” he predicted to maintain profitability in the semiconductor industry.

Reporter Woo Woo-yeon [email protected]