|

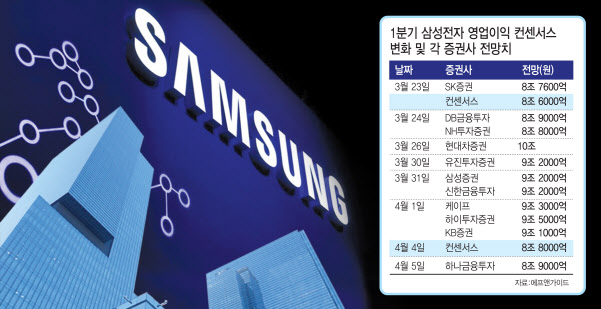

Consensus of operating profit in 2 weeks 8.6 trillion →8.8 trillion

According to the Korea Exchange on the 5th, ended at 85,400 won, an increase of 600 won (0.71%) compared to the previous trading day. It climbed to 86,000 won during the intraday and entered the 86,000 won range for the first time since February 16th.

Samsung Electronics is on the rise in April. It rose 1.84% on the 1st and 2.29% on the 2nd, respectively, closing for 3 consecutive trading days. In particular, during the same period, foreigners bought 3108 billion won, 504.4 billion won, and 26.8 billion won respectively, recording net purchases every day.

This is because expectations are rising sharply ahead of Samsung Electronics’ 1Q earnings announcement on the 7th. According to F&Guide, a financial information provider, as of the previous day, Samsung Electronics’ consolidated sales in the first quarter of this year are expected to increase by 9.9% year-on-year to KRW 60,805.8 billion, and operating profit is expected to increase by 37.0% to KRW 8,834.4 billion during the same period.

The operating profit consensus was 8.600 billion won on the 23rd of last month. It was revised up by about 2.7% in just about two weeks. Looking at the outlook for each securities company during the period, there were places where they expected to reach 8 trillion won by the end of March, but most of them recorded over 9 trillion won in April. Hyundai Motor Securities, which presented the highest operating profit forecast, presented 10 trillion won on the 26th of last month. The common opinion of the analysts in charge of Samsung Electronics is that,’Even though the memory semiconductor boom has not been in full swing, the wireless mobile (IM) and consumer electronics (CE) sectors will continue to outperform the market’s outlook.”

“We have lowered our estimate from our previous estimates due to the increase in one-off costs due to the Austin Texas power outage, and we are forecasting semiconductors 3.800 billion won, IM 4.8 trillion won, CE 1.1 trillion won, and displays 460 billion won.” “Foundry fleet Considering the low yield of the process and the worldwide shortage of parts supply, it is necessary to raise the eye level of Samsung Electronics’ ability to generate profits once again.”

“In case of surpassing expectations, we expect to strengthen investor confidence and improve supply and demand for foreigners”

Samsung Electronics’ 1Q11 results are evaluated as the hottest topic in the domestic stock market. This is because it could be an inflection point for the KOSPI in time.

As soon as it entered this year, the KOSPI broke through the 3000 line at once and reached an all-time high of 3208.99 based on the closing price on January 25, and has been moving sideways around the 3100 line for more than two months. On the other hand, the Standard & Poor’s (S&P) 500 index surpassed the 4000 line for the first time after two months of consolidation on the 1st. The analysis is attributed to the passage of the 4th additional stimulus measures worth $1.9 trillion and the disclosure of an infrastructure investment plan of $2.2 trillion, as well as improvements in US economic indicators such as employment as the vaccination rate rose rapidly.

As a result, doubts about the rise of the KOSPI are growing as it is observed that the time for only the US to grow continues. Samsung Electronics’ 1Q results are expected to serve as an opportunity to eliminate this bias. In order for the KOSPI to keep up with the U.S. stock market in the section from the liquidity market to the earnings market, earnings improvement must be confirmed, and Samsung Electronics was designated as the first gateway.

Seo Jeong-hoon, a researcher at Samsung Securities, said, “The domestic stock market will enter the full-fledged earnings season starting with Samsung Electronics’ provisional earnings announcement this week. If the expectations are exceeded, the confidence of investors will be further strengthened, and the supply and demand of foreigners, which has been sluggish so far, can also improve.”

Despite the recent outlook, there is around 8 trillion won

However, some point out that the recent increase in expectations for Samsung Electronics’ 1Q earnings could be a poison. If expectations are low, the likelihood of a surprise increases, as the recent situation is raising hurdles on the contrary.

An expert in the financial industry advised, “As the maximum expected value has reached 10 trillion won, people will not be satisfied with the extent of slightly exceeding the consensus now,” he advised. “From this point of view, it is necessary to look at Samsung Electronics’ earnings outlook.”

In fact, some brokerage firms have expected operating profits of 8 trillion won, even though they came up with the most recent forecasts. Kim Kyung-min, a researcher at Hana Financial Investment, who presented KRW 8.91 trillion on the day, pointed out that it is necessary to keep an eye on changes in semiconductor export data.

He said, “In February, exports of electronic components recorded an increase of 14.4%, which was lower than that of other industries such as plastics and rubber (18.8%) and machinery (16.2%) in the same period of the previous year. In the case of exports of semiconductors to Korea, electrons accounted for 8.6% in March, which was sluggish compared to petrochemicals (48.5%) and automobiles (15.3%).”

“If the growth rate of semiconductor/electronic component exports is lower than that of other industries in March, once again in Taiwan’s electronic component exports, the impact of export data on the semiconductor industry will be neutral and limited, and whether individual semiconductor companies’ 1Q earnings surprise? Is expected to have an effect.”