[아이뉴스24 서민지 기자] While the growth of the global foundry market is expected to continue, competition between Samsung Electronics and TSMC is expected to continue fierce this year. In particular, it is expected to accelerate the development of ultra-fine processes to preoccupy the future market.

According to Trend Force on the 6th, the size of the foundry market this year is expected to increase by 6% compared to the previous year to reach 87.9 billion dollars (about 97.5 trillion won). It is predicted that demand for parts will increase as the smartphone, server, laptop, and TV automobile markets grow 2~9%.

The gap between TSMC and Samsung Electronics is unlikely to close easily. TSMC is expected to maintain a 54% market share this year following last year. Samsung Electronics is expected to record 18%, a slight increase of 1 percentage point this year from 17% last year.

However, the gap is not large in the tip process of 10 nanometers or less. This year, TSMC and Samsung Electronics are expected to share 60% and 40% of the leading-edge foundry market, respectively.

Accordingly, competition between Samsung Electronics and TSMC over ultra-fine processes is expected to become more intense. Samsung Electronics and TSMC are the only companies capable of microprocessing, and Chinese SMIC has been difficult to enter due to US sanctions.

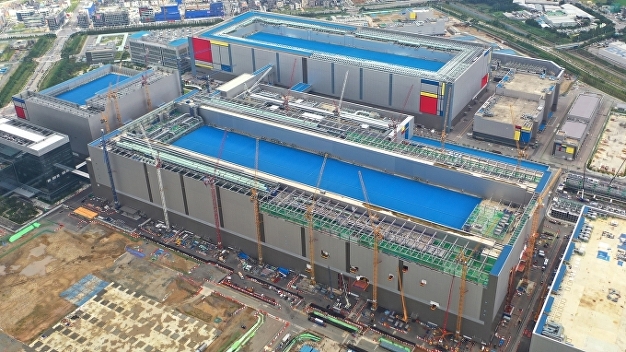

Samsung Electronics and TSMC are expected to focus on expanding their 5-nano process production capacity by 2022. Currently, Samsung Electronics has received orders for 5~7nm products from Qualcomm and Nvidia, TSMC from Apple, AMD, and MediaTek, and high-performance computing (HPC) orders are expected to increase significantly in 2022.

In order to commercialize the 3-nano process, the company plans to accelerate its development. Both Samsung Electronics and TSMC plan to begin mass production of 3-nano class semiconductors in 2022.

As the two companies apply different technologies, it is highly likely to show a difference in technology at the 3-nano class. Samsung Electronics introduces Gate All Around (GAA) in the 3-nano class process, while TSMC uses the existing’Finpet’ technology.

GAA is a next-generation transistor structure, with a gate covering all four sides of the channel to control the flow of current more precisely. In the case of Finpet, only three sides are used as gates. However, GAA is the first process to be applied, the structure is very complex, and the process is difficult, so it may take time to stabilize the yield.

Accordingly, industry analysis is that the market game may change depending on securing ultra-fine process technology.

Song Myung-seop, a researcher at Hi Investment & Securities, said, “In order for Samsung Electronics to close the gap with TSMC, it must show performance and yield beyond TSMC through the success of new technologies such as GAA at the 3-nano class.” There is,” he diagnosed.

Young-san Choi, a researcher at Ebest Investment & Securities, said, “Samsung Electronics’ share of the foundry is never low, and it is very difficult for other foundry companies to enter the 10nm or less process. It is believed that the market share can be sufficiently increased to the level of 30-40%.”

Reporter Minji Seo [email protected]