Input 2021.01.04 15:59

These are especially Samsung Electronics (005930), Samsung SDI (006400), LG Electronics (066570), LG Chem (051910)The ETF that incorporated Due to this year’s’semiconductor super cycle (long-term boom),’ Samsung Electronics is predicting ‘100,000 electrons’ beyond ‘90,000 electrons’. LG Chem and Samsung SDI, which are considered to be the leading rechargeable battery stocks due to electric vehicles, also have bright prospects. LG Electronics, which is entering the electric vehicle business, is also rising day by day.

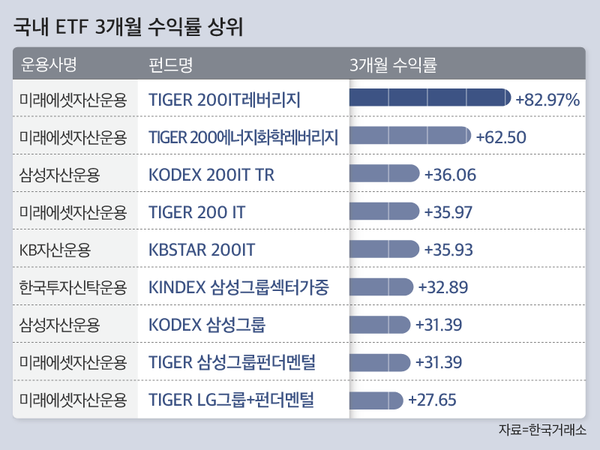

According to the Korea Exchange on the 4th, the 3-month yield of Mirae Asset Asset Management’s’TIGER 200IT Leverage’ ETF recorded 82.97% as of December 30 last year. It ranks first among 468 ETF products listed on the domestic stock market in terms of 3-month yield. With the leverage effect, the yield rose vertically.

This ETF incorporated Samsung SDI, Samsung Electronics, and LG Electronics. It also contains 114.57% of the’TIGER 200IT’ ETF that incorporates Samsung SDI (20.37%), Samsung Electronics (20.04%), and LG Electronics (11.52%). Leveraged ETF products are products that are operated with the goal of producing a performance equivalent to twice the return on the underlying index. To this end, invest in stocks and derivatives so that the share of stock investment is 200%.

An official from the financial investment industry said, “The name of the rechargeable battery is not included in the product name. In fact, it is safe to see it as a rechargeable battery ETF that contains a large proportion of LG Chem.”

Among the domestic industry and theme ETFs, Samsung Asset Management’s’KODEX 200IT TR’, Mirae Asset Asset Management’s’TIGER 200IT’, and KB Asset Management’s’KBSTAR 200IT’ ranked in the top 5 for 3 months. These yields ranged from 35 to 36%, all of which included Samsung Electronics, Samsung SDI, and LG Electronics.

In particular, the yield of ETFs with Samsung on the front is also high. The three-month yield of’KINDEX Samsung Group Sector Weight’ of Korea Investment Trust Management is 32.89%. Samsung Asset Management’s’KODEX Samsung Group’ and Mirae Asset Asset Management’s’TIGER Samsung Group Fundamental’ all have a 3-month return of 31.39%. They ranked in the top 15 in terms of returns among domestic industry and theme ETFs. The’TIGER LG Group + Fundamental’ product, which contains 18.54% and 18.29% of LG Chem and LG Electronics, respectively, recorded a return of 27.65% in the last three months.

Experts predict that ETFs containing Samsung and LG Group will be successful this year. On this day, Kiwoom Securities presented a target price of 100,000 won for Samsung Securities. The outlook for LG Chem and Samsung SDI, which are considered the leading rechargeable battery stocks due to the electric car rally, is also bright. SK Securities researcher Kim Young-woo analyzed that “the shortage of secondary battery supply could lead to a long period of time,” and “The launch of the Tesla low-end electric vehicle model is expected to further stimulate the demand for secondary batteries.”

LG Electronics is also expected to continue to be affected by electric vehicles. LG Electronics, which had a share price of 80,000 won in the early December of last year, has a share price of 140,000 won on the news of establishing a joint venture (JV) for the production of electric vehicle powertrains (power transmission devices) with Magna International, the world’s third-largest auto parts maker, on the 23rd of the same month. Beyond.

Nam-ki Kim, head of the ETF Management Division, Mirae Asset Asset Management, said, “ETF investors are investing with a long-term perspective in the semiconductor and electric vehicle markets such as Samsung Electronics and LG Chem, away from the’don’t ask investment’.” As a result, the rise in ETFs will not change rapidly.”