Input 2021.03.08 15:14

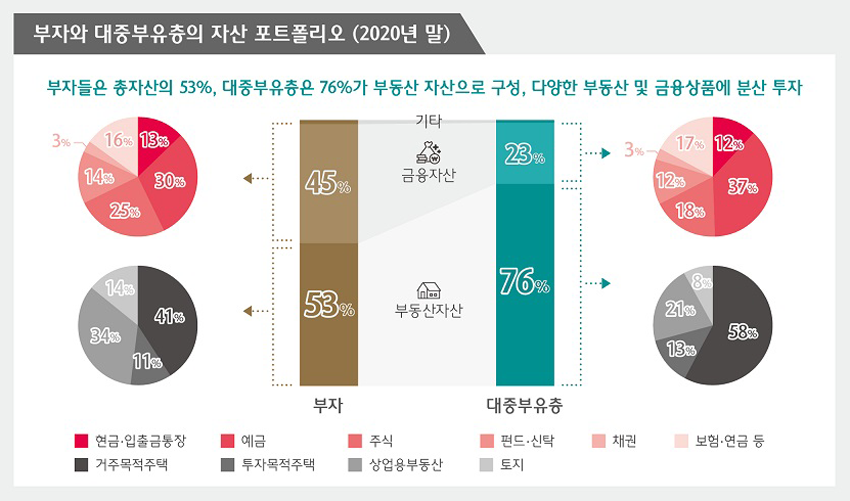

On the 8th, Hana Bank’s Hana Financial Management Research Institute published the ‘2021 Korean Wealth Report: Wealth Management Trends of the Rich and the Massive’. The criteria for the rich and the rich as defined by the research institute are financial assets of 1 billion won or more and 100 million won or more, respectively.

◇ Clearly preferring stock investment to real estate

Last year, the rich tried to change the composition of their financial assets. While the share of safe assets such as cash and deposits increased, the share of stocks also increased. As the reliability of private equity products fell, the proportion of funds and trusts decreased, and the proportion of long-term products such as insurance and pensions increased.

In particular, both the rich and the masses showed a tendency to actively participate in stock investment. 53% of the rich and 48% of the rich in the public responded that their share of stocks increased after the novel coronavirus infection (Corona 19).

View larger image

View larger imageWhile more than half of them said they would maintain their current asset composition this year, more respondents said they would increase the proportion of financial assets such as stocks rather than real estate if they plan to change them. In particular, 29% of high-value real estate assets of 5 billion won or more answered that they would reduce the proportion of real estate, which was analyzed to be due to the increased tax burden related to real estate.

On the other hand, it was revealed that it plans to expand stock investment. Most of the rich and rich in the masses predicted that the stock price will rise gradually this year. The rich who predicted a decline in stock prices were 34% of the total, and only 24% of the masses were wealthy.

Lee Soo-young, a research fellow at the Hana Financial Management Research Institute, said, “The rich and the masses are predominantly responding to withholding the decision to rebalancing assets (rebalancing the proportion of assets). It is expected to actively pursue profits through investments in domestic and overseas stocks, index-linked products, and equity-type funds while maintaining a certain ratio of deposits and deposits.”

◇ “This year’s real estate investment will be maintained as it is”

The rich and the rich said that they would maintain their current asset composition while watching the real estate market for the time being. 52% of them expect the real estate economy to deteriorate.

In fact, more than half of the rich and the public said they would not buy or sell additional real estate this year. 51% said they will maintain their current asset composition this year. This rate was the highest in the last five years. 8% of respondents said that they plan to increase the proportion of real estate, the lowest among the last five years.

The response of the rich to decide whether to buy or not based on the policy change fell from 42% last year to 26%, and the response to decide whether to sell it decreased from 30% to 21%. Hana Financial Management Research Institute explained that “the government’s strong commitment to policy was confirmed, and as the tax burden related to real estate increased, the position of the wealthy seemed to have changed.”

View larger image

View larger image