![Volkswagen's German plant has recently been shut down due to semiconductor supply and demand problems. [로이터=연합뉴스]](https://i0.wp.com/pds.joins.com/news/component/htmlphoto_mmdata/202102/07/922d1f00-b06e-4741-8f22-85cd14e29e7e.jpg?w=560&ssl=1)

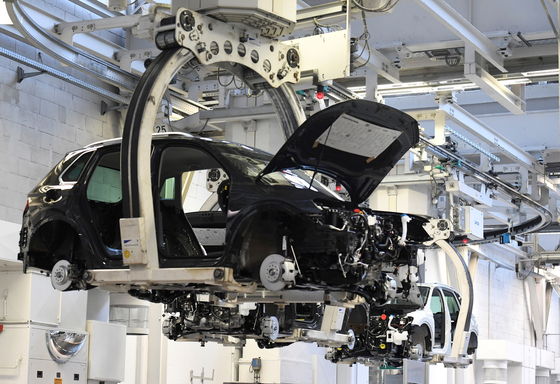

Volkswagen’s German plant has recently been shut down due to semiconductor supply and demand problems. [로이터=연합뉴스]

The Renault-Nissan Alliance, which is competing with Volkswagen and Toyota for the number one car sales in the world, also announced a production cut due to lack of semiconductors. On the 5th (local time), Renault said, “It will stop production for several days at a factory in France and in Morocco and Romania.” On the 7th, Renault Samsung showed a position that “there is a lot of stock and there is no problem with production in February.” Prior to this, GM Korea recently decided to cut the daily production at its Bupyeong 2 plant by half as a problem occurred in the supply and demand of parts containing semiconductors at the headquarters level of General Motors (GM) in the United States.

The supply and demand shortage of automotive semiconductors spread to the world

The reason automakers have recently suffered from semiconductor shortages is that production of automotive semiconductor companies such as German Infineon, Japanese Renesas, and Swiss STMicroelectronics are not meeting demand. An automobile industry official said, “Recently, the number of semiconductors in vehicles is increasing, because the production of existing semiconductor companies cannot keep up.”

It is an analysis that the shortage of semiconductors for vehicles is far from the shortage of production of semiconductors for vehicles such as TSMC of Taiwan, a semiconductor consignment production company that some have raised. Unlike STMicron and NXP in the Netherlands, which are known to design semiconductors for vehicles and leave production to TSMC, they are also producing themselves. Vehicle semiconductors can be sufficiently produced in a process of 30 to 40 nanometers (nm·100,000ths of a meter), so mass production is easier than semiconductors under 10 nm installed in mobile products such as smartphones. Professor Park Jae-geun of Hanyang University (Faculty of Convergence Electronics Engineering) said, “Vehicle chips are mainly mass-produced in factories where depreciation is omitted.” .

Share of global automotive semiconductor suppliers. Graphic = Reporter Kim Young-ok [email protected]

Semiconductor required for autonomous vehicles. Source: Eugene Investment & Securities

As the supply and demand for automotive semiconductors spread, only Hyundai Motors remained among the global’Big 5′(Toyota, Volkswagen, Renault-Nissan, GM, Hyundai and Kia) that did not cause any disruption in production. In the fourth quarter conference call on the 27th of last month, Kia said, “In the short term, we have prepared to prevent production disruptions, but inventory for the next 3-6 months is not ready.” In the case of major components containing semiconductors, it is known that they have at least one to two months’ worth of inventory. This is thanks to preemptive measures to prevent recurrence of a shortage of’wiring harness’ (car wire bundles) from China that occurred immediately after the Corona 19 incident.

Hyundai Motors strengthens inventory management right after Coronavirus

In fact, in the 2000s, Hyundai Motor Company introduced electronic equipment instead of hydraulic equipment in brakes and transmissions. This is a factor that was able to react more sensitively to semiconductor supply and demand than other automakers. They started designing semiconductors themselves through affiliates such as Hyundai Otron. In Korea, there are foundry fabs suitable for the production of vehicle chips such as DB Hitech and SK Hynix System IC.

![In the 2000s, Hyundai Motor Company increased the use of semiconductors in automobiles faster than other companies and pursued vertical integration. A citizen is looking at a vehicle at the Hyundai Motor Showroom in Gangnam-gu. [연합뉴스]](https://i0.wp.com/pds.joins.com/news/component/htmlphoto_mmdata/202102/07/5873e0f3-acfe-4b1d-89b4-5f3ac3b0bcbb.jpg?w=560&ssl=1)

In the 2000s, Hyundai Motor Company increased the use of semiconductors in automobiles faster than other companies and pursued vertical integration. A citizen is looking at a vehicle at the Hyundai Motor Showroom in Gangnam-gu. [연합뉴스]

Professor Ho-geun Lee of Daedeok University (Automotive Department) said, “Hyundai Motor’s pursuit of vertical integration policy from’metal to finished cars’ in the past is helping in this situation,” he said. “However, the supply and demand situation is expected to continue until June this year, so “We have to see if it will endure until then.” Japan-based Mitsubishi UFJ Morgan Stanley Securities recently predicted that “the scale of production cuts by major automakers in the first half of this year will reach 1.5 million units.”

Reporter Kim Young-min [email protected]