Accumulated supply shortage before 2018

Excess demand for dual-income couples in their 30s

If 1 million Bogeumjari houses were supplied

※ Click the image to see it larger.

① Short supply, half the truth

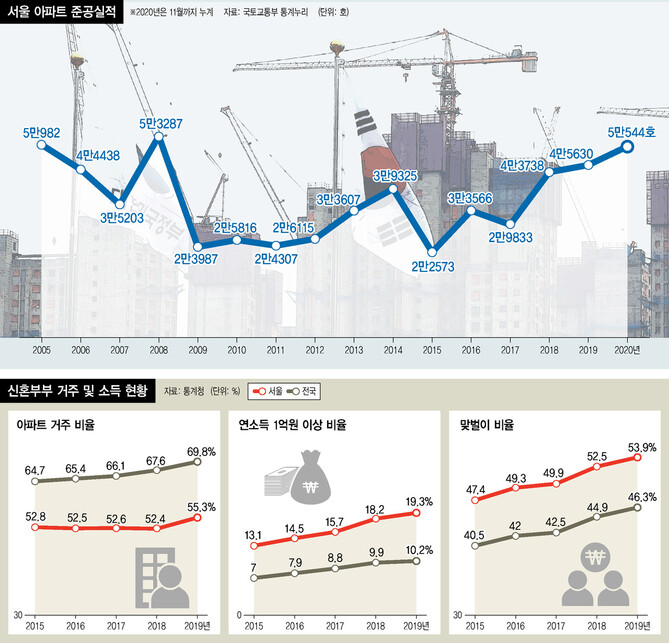

The diagnosis that’the apartment price has risen due to insufficient supply’ is half correct and half wrong. Looking at the housing completion performance from the Ministry of Land, Infrastructure and Transport in 2005-2020 (cumulative until November in 2020), Seoul apartments were supplied with an annual average of 36434 units during this period, but in 2018-2020, when apartment prices skyrocketed, the supply of apartments was 40,6637 units annually. It was the highest level ever. Although 10,000 additional units were supplied on average per year than in the past, the price has risen compared to the previous period when much smaller quantities were supplied. In the case of 2012-2014, when apartment prices were on the decline, the annual average supply of apartments was 30,016 units. According to data from the Korea Real Estate Agency, the average selling price of apartments in Seoul in January 2012 was 540 million won, but in January 2014 it fell to 490 million won. Why did apartment prices jump even though more supplies were provided than usual? It is analyzed that the temporary supply expansion cannot recover the accumulated supply shortage during the recession of the housing market. Kim Tae-seop, a senior research fellow at the Housing Industry Research Institute, said, “I see the demand for apartments as 74% of the total housing demand. If 41,000 out of the 55,000 annual housing demand in Seoul is the demand for apartments, the accumulated supply shortages before 2018 It is significant,” he said. “In the period of price spikes, demand is further stimulated by expectations of rising prices, and since there is demand from outsiders in Seoul, demand increases explosively and the supply-demand imbalance is serious.” Based on the 41,000 apartment demand per year in Seoul, 410,000 apartment units should have been supplied for 10 years, but the actual supply at this time is 349,000 units, which varies by about 61,000 units.

② The emergence of a new demand for double-income couples in their 30s

The demand for housing price spikes and declines is the difference between heaven and earth. Song In-ho, head of the Korea Development Institute (KDI) Economic Strategy Research Department, said, “Supply should approach demand relatively, but it is meaningless to simply say that it has increased a lot compared to the past.” I can achieve it.” In 2008, when the global financial crisis caused the real estate market to stagnate and housing prices turned to decline, those who bought a house by pulling out unreasonable loans when housing prices rose during the Roh Moo-hyun administration turned into’House Poor’. There were many people who lived on a cheonsei basis. This is why the previous government suffered from cheonsei measures. According to data from the Statistics Korea Population and Housing Census, Seoul’s self-occupancy rate (the percentage of people living in self-owned houses) jumped from 40.9% in 2000 to 44.6% in 2005 when house prices soared, and decreased to 41.1% in 2010 after the global financial crisis. The housing price forecast survey of the Bank of Korea Consumer Trends Survey was conducted from January 2013, and the first survey’s housing price forecast was 94, and more people predicted that’the house price will fall in one year’. This figure reached an all-time high of 132 in December of last year. ‘Double-income couples in their 30s, which are leading the recent’panic buying’ (panic buying) phenomenon, is the biggest variable that stimulates the demand for apartments in Seoul. According to Statistics Korea’s’statistics of newlyweds’, the dual-income ratio of newlyweds in Seoul (less than 5 years of marriage) in 2019 was 53.9%, the highest in the country, far higher than the national average of 46.3%. Of the 17 cities and provinces nationwide, only Seoul and Sejong are the only ones with more than 50% of double-income couples. The proportion of households with an annual income of over 100 million won is 10.2% in the whole country, and 19.3% in Seoul is doubled. It means that one out of five newlyweds in Seoul exceeds 100 million won in annual income. The irony is that the home ownership rate of newlyweds in Seoul was 37.3% (national average of 44.2%) in 2019, the lowest among 17 cities and provinces nationwide. Moreover, the apartment residence rate is 55.3% (national average 69.8%), the lowest in the country except for Jeju (32.1%). Although the income level is high, it can be said that the excess demand for apartments in Seoul occurs in this gap where the home ownership rate and the apartment residence rate are low. Professor Jung Joon-ho of Kangwon National University (Department of Real Estate) diagnosed, “Since there are relatively many full-time jobs in Seoul, there are many full-time double-income couples, and those who can use parental opportunities and bank loans have a very high level of ability to buy houses.” He continued, “Because the class that composes the real demand for homelessness has become much more complex than in the past, the government must clearly classify it and come up with measures that meet various levels of view.” “If you make a mistake, the high-income class has a hard time paying for expensive private housing. He pointed out that public housing that doesn’t fit can be in a situation of being neglected.”

③ If 1 million homes were supplied

Fundamentally, it is pointed out that the public sector should maintain stable supply regardless of the economy in a market that relies on the supply of private apartments that are jagged according to the economy. Kim Tae-seop, a senior research fellow at the Housing Industry Research Institute, said, “In the private sector, supply increases or decreases due to economic fluctuations, so even if the economy is bad, the government must accumulate housing land in advance and provide stable housing.” The July 24 measures introduced in 2013 boosted the stagnant real estate market by canceling construction of 119,000 houses in public housing areas in the metropolitan area for four years until 2016, or by delaying approvals and permits. Some of the plans for supplying homes to homes, which were attracting attention as half-price apartments, were also canceled. Bogeumjari Housing, which was a’land rental housing’, a type of public private housing that Minister of Land, Infrastructure and Transport Byeon Chang-heum had in mind, said it would supply 1 million units to the metropolitan area from 2008 to 2018, but it shrunk after the global financial crisis hit 13 It stopped supplying Manho. The projects in the Gwangmyeong and Siheung Bogeumjari districts, which were trying to supply 90,000 Bogeumjari housing units, were canceled at all. The supply of 1.27 million units in the metropolitan area determined by the government so far is also likely to take the train of Bogeumjari Housing according to economic fluctuations. In a report published in 2018, the Korea Institute of Land, Infrastructure and Transport said, “The supply of apartments tends to be concentrated when prices rise, and it takes a long time compared to other types of houses to meet demand.” If left to the self-regulation mechanism of the government, the government’s policy intervention is necessary because problems such as an increase in the burden of housing expenses and a decrease in assets are maintained for a long time due to side effects caused by supply and demand mismatch.” By Jin Myung-sun, staff reporter [email protected]