|

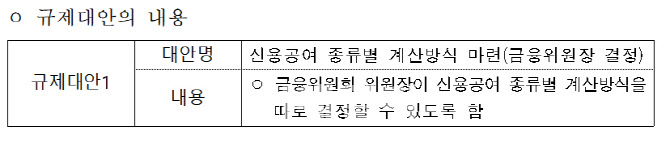

According to the financial investment industry on the 21st, the Financial Services Commission recently announced a legislative amendment to the regulations on the financial investment industry, allowing a separate calculation method for each type of credit grant. Previously, the amount of credit loans and loans was simply summed up in the calculation of the size of a credit grant, but from now on, the financial committee can decide the calculation method separately. The combined credit limit for credit loans and lenders is within 100% of the equity capital of a securities company.

The Financial Services Commission explained that the risk diversification effect is not reflected if the amount handled is simply summed up as currently, because the calculation method for each type of credit grant is not determined. The risk of default by borrowers increases when the stock price of credit loans falls and the stock price of individual loans rises. Accordingly, the Financial Services Commission is expecting the effect of expanding the handling of securities companies in credit transactions by reflecting the risk diversification effect by allowing only half of the loan amount to be recognized.

However, the financial authorities plan to keep the repayment period of individual loans at the same 60 days. In contrast, individual investors can borrow stocks in the lending market for foreigners and institutions without a period limit, but individuals have to pay them back within a short period of 60 days, raising the issue of fairness.

Finance Commissioner Eun Seong-soo attended the report on the National Assembly’s Political Affairs Committee on the 17th of last month and said, “The total amount of lenders is about 3 trillion won. “There is a controversy whether delaying helps individuals,” he said. “I will see if there is any compromise.”

The Financial Services Commission explained that it is not an unfavorable condition for individuals, as foreigners and institutions, etc., when borrowing stocks in the lending market, must repay them immediately if they request intermediate repayment.

Meanwhile, the Financial Services Commission is promoting measures to increase the number of loans by establishing a centralized system by expanding the number of securities companies currently participating in 6 loans to all 28 loans that are providing credit loans. Through this, the company plans to increase the volume of large stocks to about 1.4 trillion won, and to further increase the volume by borrowing additional stocks owned by securities companies and insurance companies.