|

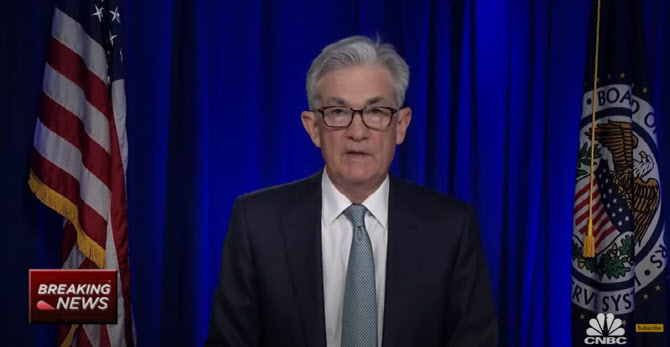

[이데일리 최정희 기자] The mayor cheered at Jerome Powell, chairman of the United States Federal Reserve (Fed), who showed off his “super pigeon”. The Dow Jones 30 Industrial Average showed strong strength, hitting the 33,000 line for the first time in history, and the domestic financial market also produced a triple bull market, in which stocks, bonds, and the won rose all at once.

According to market points on the 18th, the KOSPI index closed at 3066.01, an increase of 18.51 points and 0.61% from the previous trading day. Foreigners net bought nearly 500 billion won in 4 trading days. The KOSDAQ index also rose by 6.05 points and 0.64%, ending at 949.83, reaching the highest point since the 22nd of last month (954.29). Japan’s Nikkei and China’s Shanghai Composite Indexes also rose 1.01% and 0.51%, respectively, showing strong strength in the Asian market as a whole.

The domestic bond and foreign exchange markets were also strong. The yield on bonds under 5-year bonds fell all at once, with the 3-year Treasury bond rate falling 0.044 percentage points from the previous trading day to 1.133%. Excluding 10-year bonds, all bonds over 20-year bonds also fell. Falling bond rates mean rising bond prices. The won-dollar exchange rate was trading at 1123.70 won, down 6.50 won from the previous trading day. Based on the closing price, it is the lowest level since the 3rd of this month (1120.30 won). Since the exchange rate shows the value of the won per dollar, it means that if the exchange rate falls, the value of the won increases.

The U.S. Federal Reserve (Fed) maintained its position not to raise interest rates until the end of 2023 while raising the economic outlook at the monetary policy meeting on the 16th and 17th (local time). This year’s economic growth rate was raised from 4.2% to 6.5%. It is at a level similar to the economic growth rate suggested by China, which is synonymous with high-speed growth. Even after recording 2.4% in 2021, the inflation rate is expected to be 2.0% in 2022 and 2.1% in 2023. This is more than the Fed target price (2.0% per year) for all three years.

Despite the prospect that the economic recovery will take place quickly, Chairman Powell showed the dove side without boldness. At a press conference, he said, “FOMC has said that it will continue to purchase assets ($120 billion per month purchase) at its current rate until there is significant progress in the future. This is not a predictable progress, but an actual progress. . “This is different from our past approach.” This means that they will only touch the interest rate card after checking the economic indicators.

Chairman Powell has delivered a consistent message since the beginning of the year, but the response from the market has unfolded a relief rally more than ever, focusing on’recovery of economy, very easing monetary policy’. The Dow Jones Index rose 0.58% to a record high of 33,015.37, while the Standard & Poor’s (S&P) 500 Index rose 0.29%. The NASDAQ index also rose 0.40%. The US 10-year Treasury bond rate soared to 1.69% during the intraday, but fell to the 1.66% level after the FOMC meeting was released. However, at 4 am on the 18th (local time), the 10-year interest rate rose to 1.7%.

“Strong economic growth, moderately high inflation, rebounding corporate profits, and very easing monetary policy have created a market situation like Goldilocks,” said Anu Garger, senior global investment strategist at Commonwealth Financial Network. Goldilocks means an ideal economic situation in a modest condition, not too hot and not too cold. There is an evaluation that Powell’s consistency has worked in the market.