However, the two companies are a little different. While Kakao will focus on transactions between acquaintances based on Kakao Talk, Naver will focus on insurance comparison searches that make the most of its position as the number one search in Korea.

|

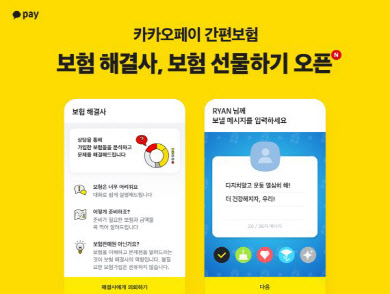

Kakao Pay plans to focus on insurance sales on the’transactions between acquaintances’ based on Kakao Talk. It’s like sending an emoticon to a familiar person with insurance products. Already in October of last year, Kakao Pay’s’Insurance Gifting’ can be seen as an extension of this’acquaintance transaction’.

Insurance gifting is a product designed so that the person who gave the gift bears the premium and the benefits of compensation go to the person who received the gift. Insurance is the concept of recommending gifts to acquaintances, just as you give vitamins to worry about the other person’s health. Kakao Pay mainly sells sports insurance products against injuries from outside activities such as sports.

‘Gift insurance’ is already showing tangible results in insurance fintech startups. Bomap, an Insuretech company, sold’Reliable Home Insurance’ as an insurance gift in August 2019, and received high praise from people in their 20s and 30s. ‘Wedding Insurance’ was also released in the form of’gift insurance’ for unexpected wedding cancellations and honeymoon changes.

On the other hand, Naver Financial focuses on’information’. As the parent company Naver has grown into an information search portal, the main goal is to provide insurance information that target consumers need. This is the first business plan to recommend insurance products to target consumers and increase sales with brokerage fees or advertising expenses.

Naver Financial has been introducing compulsory insurance products for small business owners since last November. It introduces compulsory insurance that they must subscribe to, targeting online businesses entering smart stores. For example, if there is a warehouse storing inventory items, fire insurance is recommended, and if member information is stored,’personal information liability insurance’ is recommended.

The insurance industry expects Naver to further grow its insurance brokerage platform in the future. Although it is a department store-style insurance platform, the future of the insurance platform that Naver believes is that it recommends essential insurance products to users.

An official in the insurance industry said, “If big techs, which have a large amount of data and have the best data analysis capabilities in Korea, enter the insurance industry, the domestic insurance market will also change greatly.” You will have to compete fiercely.”