Also seeking measures to block the inflow of speculative demand due to special supply measures

Unstable housing market still, it is difficult to stabilize the market by supply alone

Inflection point before June…If the decline in the first half is not reversed, the second half will be difficult

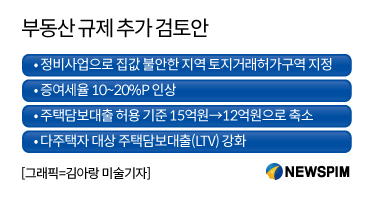

[서울=뉴스핌] Reporter Dong-Hoon Lee = In addition to expanding housing supply, the government is devising a regulatory proposal to block speculative demand as well as measures to stabilize the real estate market scheduled for early next month.

It is believed that before June, when the comprehensive real estate tax and capital gains tax are due to be heavy, will be an inflection point in the housing market. It is calculated that there is a limit to market stabilization only by expanding supply due to the recent rise in house prices. The expansion of land transaction permission zone designation, increase in gift tax rate, and loan regulation are considered as strong cards.

◆ Review of the designation of land trading zones in the Gangbuk region of Seoul… Adjusted for a 10-20%P increase in donation tax rates

According to politics and the real estate industry on the 22nd, observations are flowing that the government will add a plan to regulate the market to the 25th real estate measure.

Of course, the real estate countermeasures that will be released before the Lunar New Year holidays are to expand the supply of special housing. In addition, it is said that measures are being sought to further block investment demand.

|

A key official from the ruling party said, “In the real estate countermeasures that will be released next month, a plan to increase housing supply from various angles, such as high-density development in the station area, designation of housing districts, and diversification of housing types, will be key.” As it is judged that demand is continuously flowing into the housing market, measures to block it are also being sought.”

First of all, the designation of land transaction permission zones will be expanded. Areas in which house or land prices rise or are likely to rise sharply may be designated as a land transaction permission zone. It has the effect of blocking speculative demand in a short period of time. After designation, it is necessary to obtain permission from the head of the local government for trading. Other than end-users, land and housing in the area cannot be purchased. Candidates include the area of Sanggye-dong, Nowon-gu, and the area of the railroad base window in Yongsan-gu, where there are high expectations for full-scale maintenance and large-scale development.

Currently, part of the Gangnam area is designated in Seoul. In June of last year, the government grouped four dongs including ▲Samseong-dong ▲Cheongdang-dong ▲Daechi-dong and Jamsil-dong as land license trading zones. The designated period is one year and will be canceled on June 23. Recently, a plan to postpone the designation is being considered as house prices continue to rise, mainly for maintenance projects.

The strengthening of the gift tax rate is strongly promoted. This is because the proportion of multi-homed people using donations rather than disposing of their homes has increased rapidly. The gift tax rate is up to 50%. The transfer tax rate for multi-homed people applied in the adjusted area is lower than the maximum 62%. After June, it rises to 75%, further widening the gap. As the number of expedient donations to avoid the transfer tax has soared, the government thinks that it is necessary to regulate it.

According to the actual status of apartment transactions at the Korea Real Estate Agency (as of the reporting date), the number of apartment donations nationwide last year was 91,866 cases, the largest since the statistics were released in 2006. This is a 43% increase from the previous year. This is because multi-homed people don’t dispose of them as tax burdens grow, but give gifts to their families.

Loan regulation is also considered one of the methods. You cannot receive a mortgage loan when you purchase a house worth more than 1.5 billion won in a speculative area and an overheated area with the ’12·16 Real Estate Plan’ in 2019. It is possible to lower this standard to 900 million won or 1.2 billion won. The intention is to limit the purchase of expensive homes by cash-rich people. Excluding one homeowner, it is likely to be applied to two or more homeowners.

◆ Housing market inflection point before June, regulatory strengthening stance continues

The government’s real estate regulation policy is expected to continue this year. This is because it is judged as an important inflection point to stabilize the housing market before June 1, when the final tax rate increase and the heavy transfer tax take effect.

After June, the burden of the ownership tax and the transfer tax is expected to increase, leading to a sharp decline in the disposal of goods by multi-homeowners. Even now, it is a seller’s dominant market, resulting in a supply-demand imbalance due to a lack of sales. It is difficult to expect a decline in house prices if the number of occupants in the Seoul area has declined sharply from this year and the private market disappears.

Regulations on maintenance projects such as reconstruction and redevelopment will continue. When the union leads its own business, it does not plan to benefit from the vertical enhancement and specialized design regulations. The policy is to provide incentives for public reconstruction and public redevelopment projects in cooperation with public institutions.

However, it is still doubtful whether the policy will be effective even if the regulation changes. It is unclear whether a short-term effect will occur in public-led supply policy as it requires physical time. In the end, it is unclear whether multi-households and corporations will move due to tax reinforcement, although the private market needs to expand supply.

Dae-Jung Kwon, professor of the Department of Real Estate at Myongji University, said, “There are more factors to increase the sale price this year due to the decrease in the amount of occupancy, low interest rates, and increase in demand.” “He said.