The’overseas direct purchase virtual card’ service, which can be used by domestic consumers to directly purchase goods overseas, will be expanded to the entire card business.

Unlike domestic franchisees, overseas online franchisees often directly store card information without encryption, so a temporary card number should be used to prepare for possible leakage of card information.

The Financial Supervisory Service announced on the 27th that the virtual card issuance service, which is being implemented by some card companies, will be gradually expanded to all card companies starting next month.

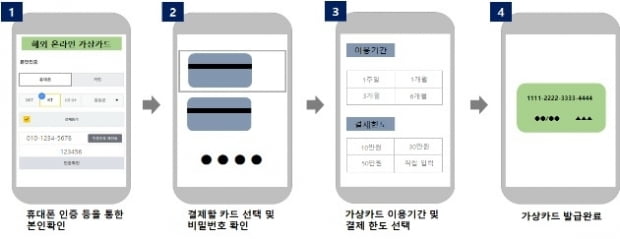

Consumers with cards issued in partnership with international brands such as VISA, Master, AMEX, UnionPay, and JCB with domestic card companies can apply for a virtual card through each card company application or website. I can.

It is a structure in which card numbers and CVC codes for overseas transactions are issued by setting an expiration date from 1 week to 1 year.

Depending on the credit card company, you may set a weekly/monthly payment limit or limit the number of payments.

The Financial Supervisory Service explained, “We have strengthened security through virtual cards that can only be used for a certain period of time, while minimizing inconvenience by allowing consumers to freely select the expiration date and the number of times of use.”

Unlike in Korea, where online payments require ARS authentication and password input, in many overseas online merchants, you only need to enter the card number, expiration date, and CVC code.

For this reason, the Financial Supervisory Service pointed out that if card information is leaked due to hacking at some overseas affiliates with weak security, a third party can use it immediately, so security should be paid special attention.

For about three years from 2018 to August this year, the amount that domestic consumers paid by card at overseas online franchisees amounted to 21.97 trillion won.

The proportion of online payments among all online and offline payments rose from 52% in 2018 to 67.8% this year.

/yunhap news

Ⓒ Hankyung.com prohibits unauthorized reproduction and redistribution