(Photo = Financial Committee)

The’Capital Market Act Enforcement Decree’ amendment’ to protect private equity investors and strengthen management and supervision has passed the State Council.

According to the Financial Services Commission on the 9th, this amendment is a follow-up measure of the’Private Equity Status Assessment and System Improvement Plan’ in April of last year, and contains system improvements to protect private equity investors and strengthen management and supervision.

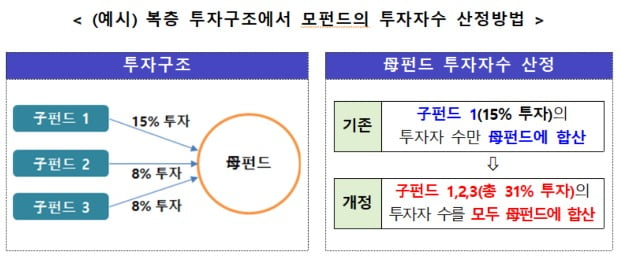

In addition to the current number of investors (49 or less), the amendment adds up to the number of investors in the parent fund when multiple sub-funds managed by the same manager invest 30% or more in the parent fund. I made it.

In addition, cross- and circular investments between own funds and the use of other funds for this purpose were prohibited as unsound business practices.

The use of other funds to avoid the prohibition of setting up a one-person fund and forcing to join the fund under the condition of investing in fund funding were also prohibited as unsound business practices.

In addition, the filing cycle of the business report was shortened to’quarterly’ so that the supervisory authority could more closely monitor the management status of the private equity fund, and the contents of the business report were expanded.

The Financial Services Commission said, “The revised bill of the Capital Markets Act, which has passed the State Council meeting, will take effect immediately after promulgation.”

Eunji Cha, reporter Hankyung.com [email protected]

Ⓒ Hankyung.com prohibits unauthorized reproduction and redistribution