Kumho Petrochemical Chairman Park Chan-gu, who was attacked by his nephew, Managing Director Park Chul-wan, launched a counterattack. It has revealed its vision to enter promising businesses such as rechargeable batteries (batteries) and bio, and double its sales within five years. It is a plan to hold shareholders’ votes ahead of the general shareholders’ meeting. Chairman Park also decided to raise the dividend by nearly three times compared to the previous one and to strengthen management transparency. It was decided not to put on the agenda for the’disruptive dividend plan’ proposed by Park. Instead, it promised growth through large-scale investment. At the regular shareholders’ meeting on the 26th of this month, attention is focused on what choices the shareholders will make.

○ Launching new business through M&A

The core of Kumho Petrochemical’s new vision on the 9th is to increase sales through investment. The sales target for 2025 was set at 9 trillion won. It is about twice as much as last year’s sales (about 4.8 trillion won). In order to achieve the goal, it is difficult only with existing businesses such as NB Latex. The company decided that promising new business investments should be made. It decided to enter into new businesses such as battery and bio. It plans to achieve 1.7 trillion won in sales by 2025 only in new businesses through mergers and acquisitions (M&A). Large-scale expansion of existing businesses, such as cash cow NB Latex, will also be carried out. The estimated investment over the next five years will reach 3 to 4 trillion won.

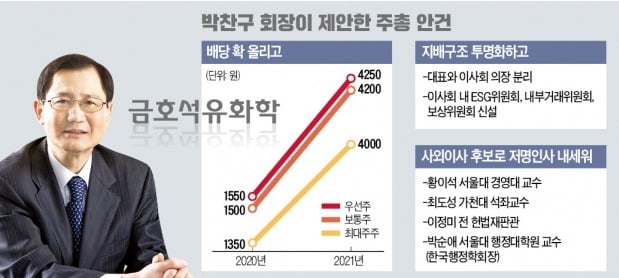

Along with investment, we also have a shareholder-friendly strategy. The agenda of the general shareholders’ meeting confirmed by the board of directors on that day included a plan to significantly increase the dividend. The dividend has been increased from 1,500 won per common share last year to 4,200 won this year. Major shareholders, such as Chairman Park, decided to receive a dividend of KRW 40 million, which is less than that of general shareholders. The preferred stock was to be expanded from 1550 won to 4250 won. The total dividend is KRW 115.8 billion. It is about 20% of last year’s net profit (582.6 billion won).

The function of the board of directors is also greatly strengthened. The company’s representative and the chairman of the board of directors are separately elected, and three committees are established inside the board of directors, including environmental, social, and governance (ESG), internal transactions, and compensation. As candidates for outside directors, the audit committee recommended Hwang Yi-seok, a professor at Seoul National University Business School, Choi Do-sung, a professor at Gachon University, former Constitutional Justice Lee Jeong-mi, and a professor at Seoul National University School of Public Administration, Park Soon-ae.

○ Preliminary disposition is key

Earlier, in January, Managing Director Park made a’propaganda declaration’ to Chairman Park by making a shareholder proposal. The conflict that lasted for nearly 10 years came to the surface.

Managing Director Park tried to take over the board of directors. He demanded that all five directors who have reached the end of their term of office be filled with persons nominated by Park. It insisted that the acquisition of assets that are not related to the core business, such as the acquisition of Kumho Resort, should be stopped or sold, and listed in major affiliates such as Kumho P&B Chemical. In order to recapture management rights, it also proposed an unprecedented dividend plan. It was a dividend of 11,000 won per share for common stocks and 11050 won for preferred stocks. It was a’one shot’ to attract support for institutions and minority shareholders as they lag behind in the competition for ownership. Park’s stake is 10%, which is less than that of Chairman Park’s family (14.87%).

However, it was belatedly revealed that Park’s dividend proposal did not meet the commercial law and the articles of incorporation, so the company raised a procedural issue and decided not to put it on the agenda at all. Park’s side opposes this and is in the process of proposing a provisional injunction to the court on the agenda.

Chairman Park decided to accept some of Park’s proposals. The representative and the chairman of the board of directors were elected separately, and various committees were set up within the board of directors. Regarding the composition of the board of directors, it was decided to make the final judgment through the shareholders’ vote confrontation.

Reporter Ahn Jae-kwang [email protected]

Ⓒ Hankyung.com prohibits unauthorized reproduction and redistribution