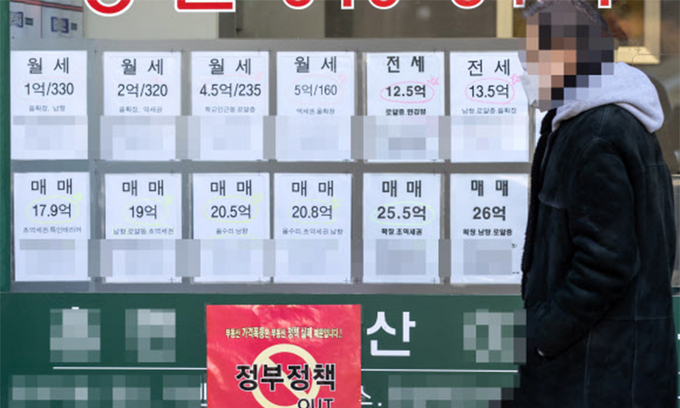

Property information attached to a real estate in Songpa-gu, Seoul. yunhap news

As the government tightened regulations on real estate in the metropolitan area, it was observed that the sales fever spread to the provinces. Despite the government’s high-strength regulations, housing transaction volume increased by 25.9% compared to the previous year, especially in the metropolitan area, but local transaction volume increased significantly. Experts diagnosed that’panic buying’ in accordance with the’crowd sentiment’ that’the price of houses will continue to rise’ has spread across the metropolitan area as the’war seismic crisis’ has intensified despite the government’s continued regulation.

◆Busan transaction volume surged 164% in one year… “Clear fat concentration”

According to the Ministry of Land, Infrastructure and Transport on the 24th, the number of housing transactions last month was 11,6758 cases, an increase of 25.9% from 9,2769 cases delivered and 26.3% from 92,413 cases in the same month last year. Compared to the five-year average (86,613 cases), this is a 34.8% increase.

In particular, last month’s housing transactions were concentrated in the provinces. The volume of transactions in the metropolitan area was 41,117 cases, a 1.8% decrease compared to the previous year and 15.3% compared to the previous year, but the local transaction volume increased 48.7% compared to the previous year and 72.4% compared to the previous year.

Busan, which was designated as an area subject to adjustment due to the recent overheating of the real estate market, had an increase of 164.6% (19,588 cases) compared to a year ago, and Gwangju (5542 cases) also increased 125.7%.

After all, the preference for apartments that were easy to calculate the sale price was high. According to data on housing transaction volume by type, apartment transaction volume (87,660 cases) increased 35.5% compared to the previous year and 34.3% compared to the previous year. The number of houses other than apartments (27,098) increased 1.9% from the previous month and 5.7% from the same month last year.

◆The proportion of monthly rent increases due to the jeonse crisis

On the other hand, the increase in the monthly rent transaction volume was insignificant or rather decreased. The total monthly rent transaction volume based on the data on the final date of last month was 17,3578, a 0.4% increase from the previous month (17,2815 cases), and 13.2% from the same month last year (153,345 cases).

The metropolitan area (11,9961 cases) increased 0.7% from the previous month and 18.6% from the same month last year. The number of provinces (53,617 cases) decreased by 0.1% compared to the previous month and increased by 2.6% compared to the same month last year.

Provided by the Ministry of Land, Infrastructure and Transport

Jeonse (10,613 cases) decreased by 2.9% compared to the previous year and increased by 7.6% compared to the same month last year. Monthly rent (72,965 cases) increased by 5.5% from the previous month and 22.0% from the same month last year.

In particular, it is evaluated that the phenomenon of’the jeonse becomes monthly rent’ is detected due to the jeonse crisis. The share of monthly rent among the monthly rent transaction volume was 42.0%, up 3.0%p from the same month last year (39.0%).

◆Expert “Expanding the nationwide’crowd sentiment’ to increase house prices”

Experts analyzed that the surge in local housing transaction volume meant that’panic buying’ spread across the country. Some point out that the failure of the government’s real estate policy, which has been subject to regulatory changes, has been revealed as a’balloon effect’ of increasing local transaction volume.

Lee Eun-hyung, a senior researcher at the Korea Institute for Construction Policy, said on the 24th, “Many people have experienced a sharp rise in real estate prices over the past few years, which has widened the gap in holding assets depending on whether or not they have homes.” Rather, it made real estate an issue. Although market demand has increased, the fact that housing supply is difficult to increase significantly in 2021 is also a negative factor for market stability.”

Researcher Lee said, “The jeonse crisis intensified as rental properties were tied up by the 2nd Lease Act, and the feeling of buying houses was revived due to low interest rates and increased liquidity.” It has spread.” He added that if the current real estate policy stance is maintained, it will be difficult for the buying sentiment to decline next year.

Information on the real transaction volume of housing sales and the actual transaction price of cheonsei is available on the real estate statistics system of the Korea Real Estate Agency or the website where the actual transaction price of the Ministry of Land is open.

Reporter Na Jin-hee [email protected]

[ⓒ 세계일보 & Segye.com, 무단전재 및 재배포 금지]