The Treasury Center introduced this way, saying, “The US 10-year Treasury bond rate surpassed 1.3% and returned to the level before the Corona 19 pandemic.”

Researcher Joo Hye-won pointed out that “the rise in US interest rates is mainly due to the continued reflation trade in line with the expectation of a large-scale US economic stimulus plan.”

Overseas financial companies believe that if the interest rate merit rises, the point at which capital withdrawal from the stock market should be 40bp higher than now.

According to the center, the BOA said that 70% of the S&P500’s companies currently offer higher returns than the 10-year interest rate, but if the interest rate rises to 1.75%, the rate will drop to 40%. In particular, considering that the average dividend yield is 1.5%, the relative attractiveness of stock investments can be reduced.

Goldman Sachs analyzed that if the rate of rise is excessively fast (more than 36bps per month), regardless of the absolute level of the U.S. Treasury bond rate, it could hurt the stock bull market.

Allianz analyzed that although inflation pressure has been insignificant over the past decade, there is a possibility that a perfect storm will appear in the second half of this year due to the resumption of economic activities accompanied by the supply of vaccines and retaliatory consumption, and stimulus measures.

Among these, TD Securities presented the next technological resistance level for interest rates at 1.36% and 1.56% on a 10-year basis. The BOA interpreted that if it exceeded 1.4%, there is a possibility of further upside due to mortgage-related convex sales (hedging treasury bond sales when interest rates rise).

■ Rising risky assets through reflation trade

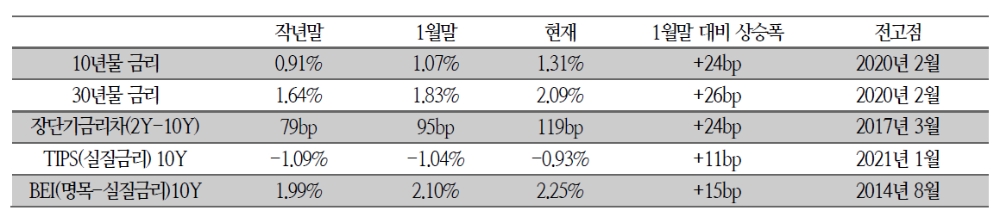

The 10-year US Treasury bond rate surged 10bp on the 16th, recording 1.31%. This is roughly the highest in a year. It has risen 23bp in the last month, and the rate of increase (+40bp) compared to the beginning of the year is the highest since 2013.

The 30-year interest rate also hit a record high of 2.09% (+8bps compared to the previous day).

The rapid rise in interest rates is due to a reflation trade in line with expectations for economic stimulus.

The economic impact of the US House of Representatives leadership’s $1.9 trillion stimulus plan, expectations for collective immunity from vaccination, inflation outlook and rising oil prices are reflected.

Risky assets such as stocks and raw materials (copper price of $8,406/1 ton; high since 2012, WTI oil of $60; +24% compared to the end of last year) and Bitcoin ($49,301; +51% compared to the end of last year) are accompanied Rose.

Reporter Chang Tae-min [email protected]

Daily Financial Economy News Copyright ⓒ Korea Financial News & FNTIMES.com

Unauthorized reproduction, copying, or distribution for commercial purposes is prohibited in accordance with copyright law.