An official from the financial investment industry said this regarding the spot-futures arbitrage of securities companies after the ban on short selling. The effect of the ban on short selling caused distortion in the derivatives market, and securities firms used it to generate relatively stable profits. It is also said that whenever the financial authorities extended the ban on short selling, brokerages’ arbitrage profits increased further.

|

“Selling futures and selling shorts continue to be a substitute for’backwardation’”

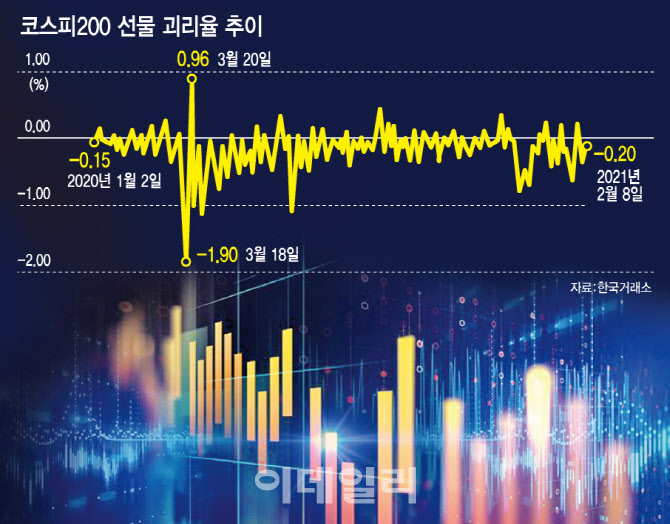

According to the Korea Exchange on the 8th, the gap between KOSPI 200 futures theorists has widened since the ban on short selling due to the Corona 19 incident in March last year. If the previous discrepancy rate moved between -0.2% and 0.2%, it fell to -0.7% immediately after the plunge. Even recently, it is moving within the range of 0.5% up and down.

Index futures are divided into theoreticians and market prices. The theorist is the spot price plus holding costs, which is the index price, including interest rates, minus the dividend. The cost of holding until expiration is added in the form of interest, and since there is no dividend for futures, the price is reduced by the dividend. In Korea, dividends are lower than in other regions, and futures are generally more expensive than in-kind contango.

Market transactions are made based on this set theorist. The gap between the theoreticians and the actual price is the gap, especially in the negative (-) direction after the ban on short selling. This is analyzed because market participants chose to sell futures as an alternative when spot short selling was blocked. As a result, short selling bans led to an increase in futures selling, leading to an undervalued futures. The gap in the discrepancy rate is also maintained at a wider level, and futures are cheaper than spots, that is, the back-wardation state of negative basis continues.

If the discrepancy rate increases in backwardation, the chance for a sell and arbitrage transaction to intervene also increases. This is because the essence of arbitrage trading is to buy an undervalued asset and at the same time sell an overvalued asset and make a profit. If the futures market price falls below the theoretician (if the discrepancy rate falls), they buy cheaper prices and at the same time make a profit by selling the relatively expensive spot.

KB Securities researcher Kim Min-gyu said, “As the demand for selling indexes and individual stock futures, which is an alternative to short selling, expands, the market basis has continued to be in a deep backwardation situation, and futures are in an undervalued state.” “It will trigger a sell-and-take transaction through a program in an instant.”

“Securities companies will move aggressively before May”

It is observed that institutional investors, especially financial investments (securities companies), have benefited from selling arbitrage that frequently appeared after the ban on short selling. This is because the cost of calculating the final profit is less than that of other investors.

Futures investment costs include securities transaction tax (0.3% points), brokerage transaction fees, and other transaction costs. For this reason, in the case of the KOSPI 200 index, the gap in spot futures must widen by 0.45 percentage points or more in order to benefit. However, financial investments (securities companies) are exempt from the stock exchange tax in the KOSPI mini futures market. This is because it acts as a liquidity provider (LP). Pension funds do not have to pay commissions in the KOSDAQ 150 futures market, and the postal service headquarters belonging to the pension funds in the entire futures market. Since only a small cost can be subtracted from the final profit, it is a structure that can jump into arbitrage trading compared to foreigners even if the gap is relatively small.

When the short sale ends, the distorted futures undervaluation disappears, so it is estimated that brokerage companies have been more active in arbitrage trading in recent years. Moreover, while playing the role of LP in the mini futures market, short selling was virtually allowed, but this function may be blocked with the resumption of short selling measures. The Financial Services Commission has announced a policy to completely ban short selling appearing in the Mini KOSPI 200 futures and options by market coordinators.

An investment industry official said, “For financial investment, if the gap in the discrepancy rate normalizes, and if the LP role is restricted, there will be no opportunity to make money.” There will be a flow of doing this.”

However, there is an observation that the actual return on investment will not be as large as expected because the short sale of the spot was limited in the sale and arbitrage trading due to the short sale restriction.

Jung In-ji, a researcher at Yuanta Securities, said, “The market basis has not been normalized due to the ban on short selling, and it seems that the chances of profit have increased for arbitrage traders. did.