The KOSPI index rebounded after a short-term adjustment. According to the analysis, it is because the’bubble boundary theory’ is growing due to the U.S. game stop incident, but no specific signs of the bubble collapse have been shown yet. Nevertheless, it is not a situation where you can watch the market without worry. It is advised that preparation for volatility is necessary as the game stop situation is still’in progress’ and the KOSPI index continues to rise or fall by an average of 2-3% per day.

What indicators should I look at

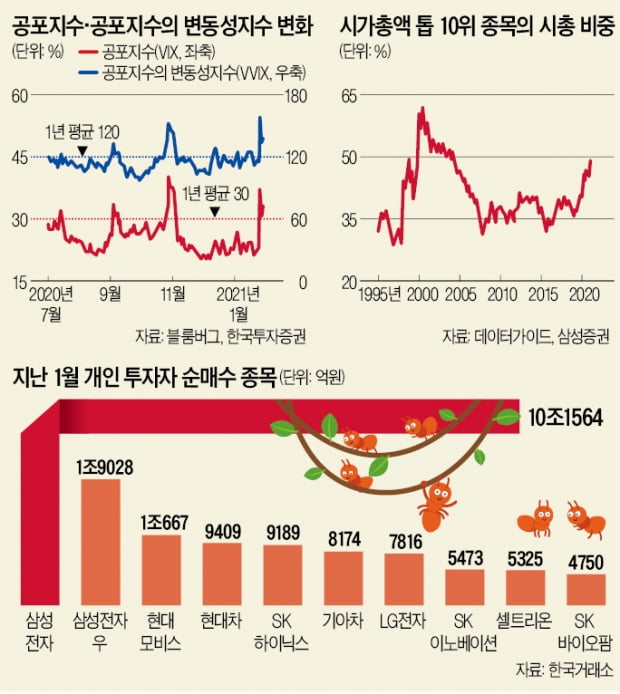

On the 1st, Korea Investment & Securities presented three external indicators to gauge the direction of the Korean stock market. First, whether or not the volatility of the US stock market is reduced. Representative indicators are the fear index (VIX) and the volatility index of the fear index (VVIX). The VIX index is an index that represents the market’s forecast of the volatility of S&P500 index options listed on the Chicago Options Exchange over the next 30 days. The VIXX index is an indicator of the volatility of this fear index. As of the 29th of last month (local time), the VIX and VVIX indexes were 33.09% and 137.33%, respectively, far exceeding the annual average. Daejun Kim, a researcher at Korea Investment & Securities Co., said, “If the VIX standard is 25% or less and the VVIX standard is 100% or less, the stock market can be considered to have entered a stable zone.” Explained.

The second is the change in interest rates (SHIBOR) between banks in Shanghai, China. This is because interest rates are the first to respond when the central bank of China determines that the economy has recovered and recovers liquidity. The 14th hourly interest rate surged to 3.8% on the 29th of last month, pouring cold water on emerging markets.

Lastly, it is the amount of foreigners’ net purchase. Foreign investors net sold 1,9848 billion won on the 26th of last month, 629 billion won on the 27th, 1.5774 trillion won on the 28th, and 1.431.1 trillion won on the 29th, respectively, increasing the stock market decline. The daily trend has changed. Although the scale is not large, it has turned to a net purchase of 100 billion won. Thanks to that, the KOSPI index also succeeded in reversing an increase of 2.70%.

What to buy

Although the stock market is undergoing an adjustment due to increased external volatility, it is evaluated that the internal uptrend of the Korean stock market is still maintained. There are expectations that Korean companies’ earnings will improve ahead of the global economic recovery and Green New Deal. The 12-month estimated net profit estimates for automobiles, chemicals, and semiconductors, which are leading domestic stock markets, have been revised up by 20% from the beginning of October 2020.

Therefore, experts recommend a strategy to focus on stocks with the highest market cap for the time being. The market capitalization of the top 10 companies in the securities market is expected to have a greater influence on the stock market. The top 10 stocks’ contribution to net profit in the securities market is expected to expand from 43.1% this year to 46.4% next year. Currently, the share of the market capitalization of the top 10 stocks in the securities market is 49.2%. In May 2000, it had soared to 62%. This means that there is still room for higher concentration of top market cap stocks in this cycle.

The fact that the investment method of’Donghak ants’, which is the main axis of the market, is changing also contributes to this analysis. January’s personal net purchase is Samsung Electronics(83,000 +1.22%) Hyundai Mobis(335,500 +5.67%) Hyundai Motor Company(238,500 +4.15%) SK hynix(125,000 +2.04%) Kia Motors(90,000 +9.09%) LG Electronics(158,000 +3.27%) It was concentrated on the top stocks of the market cap. As the volatility of the stock market expands, it is investing intensively in safe stocks, focusing on the top stocks in the market capitalization like foreigners and institutions.

It is pointed out that there is a need to pay attention to stocks related to green and mobility themes, which are recently attracting attention in the global market. “If overheating is the biggest bad news, the correction is the biggest good,” said Jung Myung-ji, head of the investment information team at Samsung Securities. Samsung Securities is Samsung Electronics Naver(348,000 +1.46%) Samsung SDI(745,000 +1.50%) cacao(441,500 +0.11%) Kia Motors SK Innovation(316,000 +12.86%) LG Electronics Samsung C&T(130,500 +0.38%) Samsung Electro-Mechanics(206,000 +0.98%) Hanwha Solutions(51,500 +3.41%) Etc. were presented as recommended events this week.

There is an opinion that it is necessary to be cautious about small and medium-cap stocks. The 3-month gap between KOSPI and KOSDAQ has widened to 18.5%. Nevertheless, it is an analysis that it will take time for the warmth to spread to KOSDAQ small and medium-sized stocks. The relative stock price of the KOSDAQ relative to the KOSPI tends to be linked to the US NFIB SME optimism index, as this index has not yet rebounded. Samsung Securities researcher Kim Yong-gu analyzed that “when the US Biden government’s additional economic stimulus measures reach congressional agreement and the optimism index for SMEs rebounds, the size rotation from large to small and mid-cap stocks will be possible in domestic and overseas markets.

Reporter Jaeyeon Ko [email protected]