As real estate giants are turning to profitable real estate to avoid the showers of the housing market regulation, office buildings, including the Little Building, are trading at record highs one after another. Although the vacancy rate has increased due to Corona 19, the value of the increase in land prices is higher than the rental yield.

“It doesn’t matter if there is vacancy” Profitable real estate’Love Call’

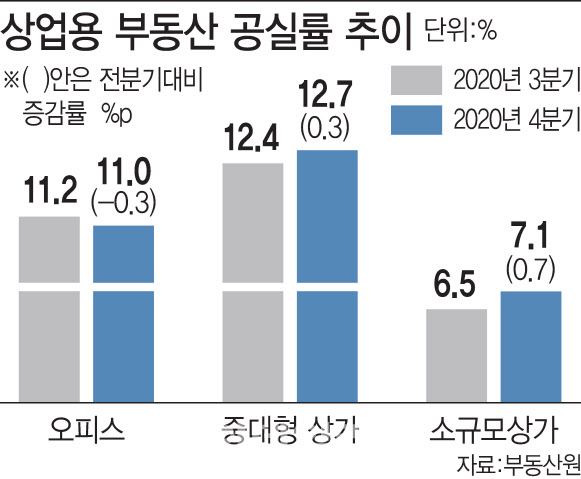

According to a survey on the commercial real estate rental trend conducted by the Korea Real Estate Agency, the vacancy rate for small-scale shopping centers (buildings with a total floor area of 330 m2 or less) in downtown Seoul was 10.5% in the fourth quarter of last year. This is a record-high 2.1 percentage point increase compared to the previous quarter. This is due to a decrease in self-employed people and an increase in business closures due to a decrease in sales due to the prolonged corona. Even for office buildings that are less affected by the corona compared to shopping malls, the vacancy rate in downtown Seoul was 10.7%, up 0.3 percentage points from the previous quarter.

|

The vacancy rate of commercial real estate has risen significantly, but its popularity is declining. Although profitability declines due to the high vacancy rate, it is not a big problem for the big players of real estate based on financial power. This is because there are many investors who expect the asset value to rise as the land price jumps.

According to the results of analyzing data by transaction purpose of the Korea Real Estate Agency by Economic Man Lab, a real estate information provider, last year, the nationwide commercial real estate transaction volume recorded 335,556 cases. This is an increase of 11% compared to the previous year (30,3515 cases).

Even the vacancy rate is an atmosphere that doesn’t care much. An official of’Bilsanam’, a brokerage firm at Little Building, said, “There are many people who invest in anticipation of an increase in asset value without paying much attention to the vacancy rate. However, because the interest rate is so low, the expected rate of return has decreased a lot.” The benchmark interest rate fell from 1.25% per year to 0.75% in March last year, when the corona crisis began to appear in earnest, and then fell 0.5%, the lowest interest rate ever recorded in May.

The popularity of profitable real estate has a great reflection on the housing market. In order to create a real-demand-oriented housing market, the government poured out 25 real estate regulations and entangled multi-homed people. In particular, as a policy to strengthen the tax burden cut off demand for housing investment, commercial real estate such as the Little Building began to emerge as new investment destinations.

Should I bundle loans for non-residential use? Concern about the balloon effect on abundant liquidity

In fact, the industry evaluates that commercial real estate loan screening has become difficult since last year. In fact, it is said that the financial authorities have issued guidelines for reducing the proportion of commercial real estate to commercial banks. An industry official said, “The RTI (rental interest repayment ratio), which determines the repayment ability based on rental income, applies only to individuals, but there has been a case of rejecting loan approval by applying it to corporations.”

Nevertheless, the number of banking sector investment counseling for profitable real estate increased significantly. Last year, the number of real estate counseling requests through the NH Nonghyup Bank’s ALL100 advisory center increased 2.6 times compared to the previous year. About 60% of all consultations were related to building purchases. Kim Hyo-seon, senior member of NH Nonghyup Bank’s real estate sector, said, “As housing-related taxes were strengthened after the June 17 and July 10 measures last year, there was a lot of demand for disposing of existing houses and investing in small buildings. As this is in full swing, investment counseling is increasing.”

The government’s ruling party tried to block in advance as the flow of funds to the commercial real estate market intensified. It officially cited the need to cut down on commercial real estate loans and began to pressure the financial sector. The market predicted that if lending regulations are implemented, it could temporarily dampen investment sentiment. However, there are also concerns that it may cause a balloon effect or side effects in the abundant liquidity market.

Bae Sang-young, a researcher at Daishin Securities, said, “If the profit-type real estate loan is regulated, the leverage effect will decrease and the profitability of real estate indirect investment products such as real estate REITs and funds will inevitably decrease.” There is” he said.

There is also a possibility that non-financial loans will increase or liquidity funds will be directed to the overseas real estate market to avoid excessive regulation. Kim Gyeong-gyu, head of the Korea Investment & Securities Institute for Asset Succession said, “The interest in overseas real estate, especially real estate investment in North America, has increased due to the adjustment of real estate prices due to the impact of Corona 19 due to the recent weak dollar.”

In particular, the demand for profitable real estate is expected to increase in the future due to the recent influence of the government’s semi-industrial area and urban development in the station area. Kim said, “As the government is developing the downtown area, there are a lot of people investing in it as expectations for nearby commercial districts increase,” he said. “Amid the recent real estate market atmosphere and low interest rates, it is questionable whether regulations can properly control the market.” said.