Lime crisis overlaps with the direct investment craze… Private equity plunges 10 trillion in one year

Avoiding “high risk” sales in the financial sector… Asset management companies shut down one after another

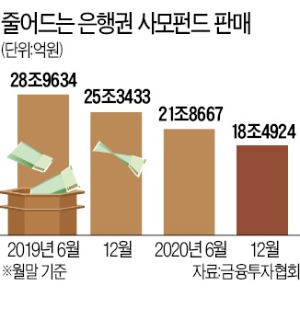

Despite the surge in stock prices, private equity funds are not getting out of the sluggish swamp. The balance of banknote sales, the largest seller, fell below 20 trillion won in the aftermath of the cessation of redemption that followed Lime and to Optimus. When individual investors turned away, the proportion of individuals in all private equity funds fell to the 4% level. There are also concerns in the industry that it could become a’private fund’ that is in crisis of death.

According to the Financial Investment Association on the 15th, the balance of banknote sales of private equity funds was 18,429.4 billion won as of the end of last year. The 20 trillion won wall was broken in 3 years and 8 months after April 2017. The sales balance, which increased to about 30 trillion won in July 2019, decreased by more than 10 trillion won in less than a year and a half. In the industry, there is an analysis that the private equity industry, which has grown rapidly since 2015, is in the worst situation despite the good news of a surge in stock prices. A representative of a hedge fund said, “There is a high possibility that there will be cases in which managers that have exploded since lowering the entry threshold of private equity funds will be closed from this year.” “There is also a movement to search for managers that are already for sale by law firms.” Told.

Another sign of a crisis is the scale of the new setting. According to the Korea Securities Depository, the size of newly established private equity funds last year fell 42.6% compared to the previous year. The newly established fund also fell 60.6% over the same period. This is the first time since 2015 that the size of the new setting has turned to a decline. Another factor in the crisis is that individual investors are turning away from private equity funds, which have fallen into a swamp of’distrust’ due to the suspension of redemption. Individuals continue to withdraw money from private equity funds. Private equity participation (investment funds) of individuals from 21,8684 trillion won in March last year decreased significantly to 17,6653 trillion won at the end of last year. Considering the fact that some of these are money that is tied to the suspension of redemption, it is analyzed that the phenomenon of individuals turning away from private equity funds is serious.

Song Hong-seon, a senior research fellow at the Capital Markets Research Institute, diagnosed, “New managers are continuing to appear in the private equity market, which is still on a deteriorating course in the midst of the booming stock market, but it will be difficult to survive unless consumer confidence is restored.”

Reporter Park Jae-won/Oh Hyeong-ju [email protected]

Ⓒ Hankyung.com prohibits unauthorized reproduction and redistribution