Hyundai Oilbank is starting to produce ethylene vinyl acetate (EVA), a material for solar panels. We believe the business outlook is bright as the prices of related materials such as EVA are soaring due to the growth of the solar power generation market. As it became difficult to make large-scale profits from the oil refining business, it jumped into the renewable energy ecosystem, a promising business. When the facilities are fully operational in the second half of this year, Hyundai Oilbank will quickly become the second largest EVA producer in Korea.

Full-scale operation of facilities in the second half of this year

According to the oil and chemical industry on the 13th, Hyundai Chemical, a subsidiary of Hyundai Oilbank, decided to produce 180,000 tons of EVA per year at the Daesan Chemical Complex (HPC Complex) in Chungnam, which is scheduled for operation in the second half of this year.

Initially, there was no plan to do much EVA production in this complex. However, the strategy changed as the demand for EVA recently increased significantly. Some of the low-density polyethylene (LDPE) facilities, which have similar production processes to EVA, were turned to EVA production. An official at Hyundai Oilbank said, “We originally planned to produce 300,000 tons of LDPE per year, but we decided to cross-produce with EVA.”

EVA is a synthetic resin mixed with ethylene and vinyl acetate, which are basic oils. It is a raw material for sports shoe sole, film adhesive, and extrusion coating. Recently, it is most often used as a material for solar panels. EVA, which has an increased vinyl acetate content of 28% or more, has good flexibility and is used as an encapsulant to protect the surface of solar panels.

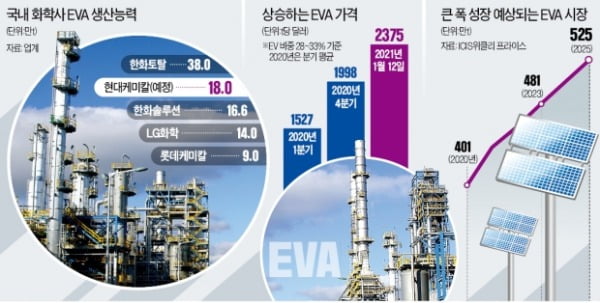

Hyundai Oilbank’s decision to produce EVA is also aimed at solar power demand. The scale of the global EVA market reached about 4 million tons and 10 trillion won as of last year. In the industry, it is expected to exceed 5 million tons and 12 trillion won in 2024. The share of Korean companies in this market is about 20%. Hanwha Total Petrochemical is the largest with 380,000 tons, followed by Hanwha Solutions (166,000 tons), LG Chemical (140,000 tons), and Lotte Chemical (90,000 tons). When Hyundai Oilbank starts full-scale production, it will quickly become the second largest EVA company after Hanwha Total. Kang Dal-ho, president of Hyundai Oilbank, said, “We are expecting an annual operating profit of 200 billion won in the EVA business alone.

EVA industry is very booming

The EVA industry is in a’super boom’ these days. Prices have been on a steep rise since the second half of last year. In the second quarter of last year, the average of only $1172 per t (the proportion of vinyl acetate 28 to 33% EVA) jumped to $1360 in the third quarter, and rose to $1998 in the fourth quarter. As of the 12th, the price has increased even more this year, trading at $2375. Product margin (EVA-naphtha spread) jumped from $735 per t in June last year to $1857 in December.

This is due to the resumption of large-scale investments in the solar power field. Investment in solar power generation facilities, which was delayed due to the novel coronavirus infection (Corona 19) in the first half of last year, increased sharply in the second half of last year. In China, the largest market, solar power generation capacity in the second half of the year increased by 40% compared to the same period last year. Han Sang-won, a researcher at Daishin Securities, predicted that “the world solar power generation demand this year will reach 150GWh, an increase of more than 25% compared to the previous year (120GWh).”

Oil refineries are rapidly advancing into eco-friendly businesses. Major European oil companies such as BP Total Shell are reducing their investment in the oil sector and focusing on renewable energy. BP recently announced that it will increase the capacity of renewable energy generation such as wind power and solar power to 50GWh by 2030. Total also plans to implement a 35GWh renewable energy project by 2025. It is at the level of 35-50 times that of the first nuclear power plant (about 1GWh).

An official from a domestic refinery said, “In terms of strengthening the environment, society, and governance (ESG), there will be more cases of domestic refineries entering eco-friendly business.”

Reporter Ahn Jae-kwang [email protected]