Until the first quarter of last year, the automotive semiconductor market did not receive much attention from the industry. The market itself was small, with around 10% of the total semiconductor market, and the profitability was low. Even if it entered the market, it took a long time for verification to supply semiconductors to automakers. However, as the demand for future vehicles such as autonomous driving and electric vehicles increases due to Corona 19, automotive semiconductors are being reevaluated. This is because automobile semiconductors are much more needed in future cars where vehicles are becoming an electronic product. Supply disruptions are also overlapping, leading to shortages. The securities industry advises diversifying investments in the structural growth of the automotive semiconductor market through global diversification investment.

○ The old semiconductor that became hot with electric vehicles

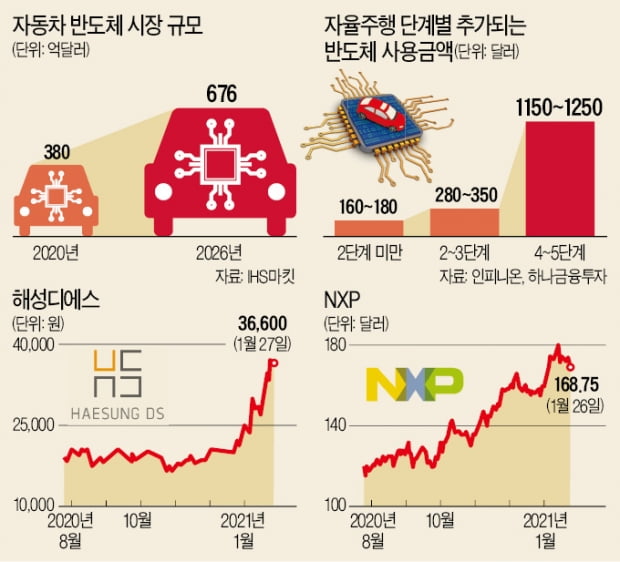

On the 27th, Haesung DS closed the deal for 36,600 won. It has increased by 50.00% this year. Haesung DS manufactures lead frames and package substrates, which are parts necessary for semiconductor packaging. Of the total sales last year, 68% were leadframes, of which half was used for automotive semiconductors. Most of the global automotive semiconductor companies are customers.

The earnings outlook is bright. According to F&Guide, a financial information company, Haesung DS’s operating profit consensus this year (average of securities companies’ estimates) is 54.1 billion won, up 24.2% from last year.

The automotive semiconductor market has entered a structural growth trend. According to market research firm IHS Markit, the global automotive semiconductor market, which was worth 38 billion dollars last year, is expected to increase to 66.7 billion dollars by 2026. In future cars where electronic devices such as electric vehicles are applied a lot, semiconductors for vehicles are inevitably used. There are 200 to 300 semiconductors for vehicles used in internal combustion engines, but more than 2,000 are needed for electric vehicles.

Song Seon-jae, a researcher at Hana Financial Investment, said, “The unit cost of automotive semiconductors is about 470 dollars from the current production cost of automobiles, but it is rapidly increasing as the automotive electronics are accelerating. Semiconductors are used.” This is about 6% of the Model 3 production cost.

Demand has increased, but supply is scarce. There are not many players. This is because automotive semiconductors are directly connected to vehicle safety, so it takes a lot of time to test for stability and compatibility. Kim Dong-won, a researcher at KB Securities, explained, “It takes 3 to 5 years to supply through the test.” This is the background of the outlook that current companies can only divide the benefits of structural growth in automotive semiconductors.

○ Required for global diversification investment

Major automotive semiconductor companies are foreign companies. Except for Haesung DS, there are virtually no related stocks in Korea. Global diversified investment is essential in order to benefit from growth.

German company Infineon Technology (IFNNY) and Nasdaq-listed Dutch company NXP Semiconductors (NXPI) are two tops. They design semiconductors and commission them to foundry companies such as TSMC and Samsung Electronics in Taiwan. Infineon took over Cyprus, an American semiconductor company, in 2019 and became the No. 1 market share. NXP Semiconductors, a Dutch company, is a customer of major automakers such as BMW, Ford, Honda, Toyota, Hyundai, and Tesla. Each has a market share of around 20%.

STMicro (STM), a Swiss analog semiconductor supplier, is also seeing a surge in automotive semiconductor sales. Automotive semiconductor sales account for about 38%. Sales in the fourth quarter of last year were $3.24 billion, exceeding expectations. This was due to the increase in sales of automotive semiconductors.

Among automotive semiconductors, the most used semiconductor is the microcontroller unit (MCU). 30% of the market is this part. Only individual roles that operate according to specific conditions are assumed. It is also the role of this semiconductor to sound an alarm when the seat belt is not worn. As electronic devices become more complex, the payload will inevitably increase. The leader in the MCU field is Japan’s Renesas Electronics. The MCU share is 31%, similar to that of NXP (31%).

Reporter Yoon Sang Ko [email protected]

Ⓒ Hankyung.com prohibits unauthorized reproduction and redistribution