Company A, a foreign company that has invested in Korea, is seriously considering a plan to withdraw from Korea. As profitability continues to deteriorate due to rising labor costs, the novel coronavirus infection (Corona 19) overlaps. A company official said, “Once last year, we reduced our investment and employment.” “The labor movement of frequent strikes and struggles is also a burden.” This is an example introduced by the Korea Employers Federation.

Lowest in 6 years of direct investment last year

52 hours per week, increase in minimum wage also affected

Double-digit worst for 2 consecutive years

“Even if the corona is over, it may be difficult to recover”

Japan cuts half of investment in trade conflict

Gates Korea, a foreign company that made rubber products for automobiles in Daegu, closed its factory last year. It is a company that has steadily made a surplus for over 30 years, and eventually chose to close it. Workers working here lost their jobs.

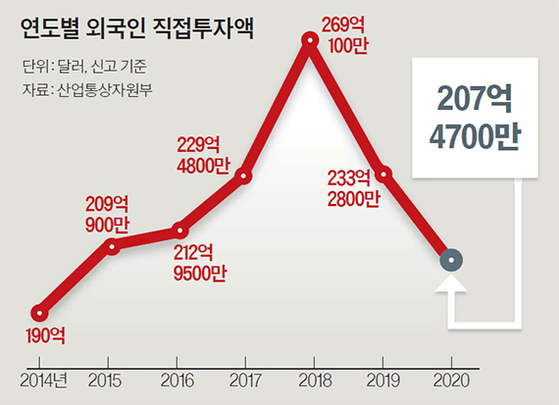

Last year, the size of foreign direct investment (FDI) was the lowest in six years. This is the aftermath of having the worst year with Corona 19 in the situation where labor costs are increasing due to the increase in the minimum wage and reduction of working hours.

Foreign direct investment by year

The Ministry of Trade, Industry and Energy announced on the 12th that last year, FDI recorded $2.74 billion as reported and $11.90 billion as of arrival. Compared to 2019, it decreased by 11.1% by report and by 17% by arrival. It is a double-digit decline for the second consecutive year since 2018. Last year’s FDI was the lowest in six years since 2014 (US$19 billion) as reported. By arrival, it was the lowest since 2013 ($9.84 billion).

Along with the spread of Corona 19 last year, there was also a structural factor preventing foreign investment. According to a survey by the Korea Employers Federation and the Korean Society for Personnel Management, 39.2% of foreign-invested companies believe that the domestic business environment is not friendly compared to other countries. It was more than twice as many as foreign-invested companies (18.4%) who viewed the domestic business environment as friendly. Foreign companies cited’employment and labor policies and laws’ (25.1%) and’labor relations’ (19.0%) as obstacles to the business environment.

Foreign investment performance by country

Among the current government’s policies, many respondents said that the biggest burdens were’shortening working hours’ (25.2%) and’drastic increase in minimum wage’ (19.2%). Company B, who responded to the survey, said, “The regulations including working 52 hours a week were introduced rapidly in a short period of time. It was not easy for companies to predict and it was even more difficult to respond.”

Company C said, “While the strike was in full swing, the labor union had picked up in front of the foreign CEO’s home during school hours. The foreign CEO was considered quite threatening and sued the union.” “When a strike occurs, the union goes to the politics first. “It’s because union politicians put pressure on companies in many ways.”

Seong Tae-yoon, a professor of economics at Yonsei University, said, “Before Corona 19, the investment environment for not only foreign-invested companies but also all companies was not good because of rising labor costs and various corporate regulations. Investor) It is difficult to recover.”

Despite the difficult environment, investments in new industries such as big data, bio, and artificial intelligence (AI) have rather increased. According to the Ministry of Industry, the amount of investment in the new industry last year was $8.42 billion. Compared to a year ago, it increased 9.3%. As the non-face-to-face economic activity emerged due to Corona 19, there were many investments in securing infrastructure such as data centers and e-commerce service distribution centers.

Looking at the amount of foreign investment by region (based on reporting) last year, Japan, which is experiencing a trade conflict, decreased by almost half (-49.1%). The United States (-34.5%) and the European Union (EU·-33.8%) also declined significantly. On the other hand, China, Hong Kong, Singapore and other Chinese regions (26.5%) increased significantly. China, in particular, reached 1.89 billion dollars, more than doubled compared to 2019.

The outlook is not good again this year. The United Nations Conference on Trade and Development (UNCTAD) predicts that this year’s global FDI will decrease by 5-10% from last year.

Sejong = Reporter Kim Namjun [email protected]