[아시아경제 이민지 기자] NHN’s overall performance was sluggish as the web game division’s performance declined in the aftermath of the novel coronavirus infection (Corona 19) last year, but this year, it is expected to make a solid performance thanks to the recovery of fintech and game business.

According to Meritz Securities on the 16th, sales and operating profit in the fourth quarter of last year are expected to increase by 10.5% and 56.7% from the same period last year to 44.2 billion won and 27.4 billion won. In 4Q, sales and operating profit of W44.5bn and W32.3bn are expected to be slightly below market estimates.

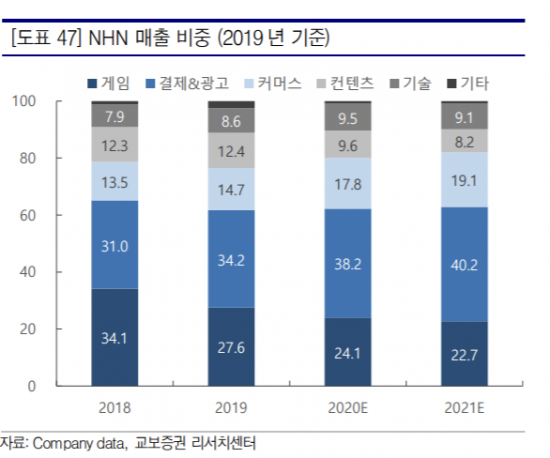

The web board game had an increase in usage due to the Chuseok effect and winter in October, but as the corona 19 intensified, the negative impact of the PC cafe business restrictions was more reflected. Businesses such as payment, advertisement, commerce, and technology reflected the effect of seasonal high season. However, in the case of NHN Accommate, which has a China-based e-commerce business, the effect was dispersed by dividing the Gwanggun system in two, and PNP Secure has limited sales growth due to the absence of face-to-face sales due to Corona 19. appear. The operating margin was 6.2%, similar to the previous quarter.

Labor costs were incurred due to the dismissal of executives due to poor performance in the game business, and marketing expenses increased due to the progress of Japanese TV advertisements related to’AMS. Net profit turned to the red due to losses on valuation of intangible assets related to Bugs and travel doctors.

NHN’s share price this year is expected to be determined by the performance of the game division and fintech. Korea Investment & Securities researcher Jung Ho-yoon said, “To achieve full-fledged performance improvement, mobile game success is necessary. We need to watch the success of four new titles such as Idol Masters, which are scheduled to be released in the first half.”

Fintech business performance is also important. At the end of last year, NHN launched a Payco investment service that allows you to invest in funds and bonds through Payco. Although competition in the fintech industry is fierce around Kakao and Naver, Payco’s investment service, which has more than 4 million monthly service users (MAU), is expected to contribute to this year’s earnings.

There is also an expectation for the my data business. NHN is expected to build a profit model based on the acquisition of My Data itself. On the 27th, the Financial Services Commission plans to issue a personal price related to My Data, and NHN’s Payco can be obtained without difficulty. Getting a license doesn’t mean you can add a business model right away. Kang Da-ye, a researcher at Meritz Securities, said, “By establishing a technical process that links APIs with financial institutions, we will be able to implement a revenue model such as My Data-related advertisements, commissions, and user reporting subscriptions from the third quarter.”

Researcher Kang said, “As the negative impact of Corona 19 was reflected, Payco’s transaction amount increased by about 20% compared to the same period last year, and showed a slump compared to competitors.” , And the campus zone is expected to grow.”

Reporter Lee Min-ji [email protected]