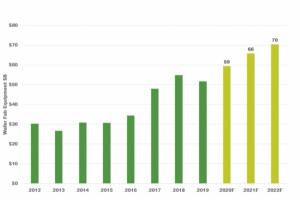

Next year is better than this year, expected $70 billion

It is predicted that the equipment market will grow to the largest ever with the entry of the semiconductor super cycle.

At the Semicon Korea conference on the 3rd, a researcher from Crack Tseng International Semiconductor Equipment and Materials Association (SEMI) said, “As a result of collecting the forecasts of eight market research companies, the semiconductor market is expected to grow by an average of 9% this year. , Semiconductor materials, testing, packaging, etc. will be the largest investment ever in history.”

The size of the semiconductor equipment market this year is $66 billion (about 73.69 trillion won). It is expected to exceed 70 billion dollars (about 79 trillion won) next year. Compared to the $30 billion market in 2012, it more than doubled in 10 years.

Wafer fab equipment investment this year is the largest in foundries and logic. SEMI is expected to invest $35 billion in foundries and logic in 2022. NAND flash and DRAM equipment is expected to invest 22 billion dollars this year. This is because the market growth of 5G mobile communications (5G), data centers, servers, artificial intelligence (AI), high-end computing (HPC), and autonomous vehicles is expected to lead to high demand across all semiconductor fields.

Last year, $58 billion was invested in test equipment. The market is expected to surpass $60 billion for the first time this year and hit $68 billion next year. Demand for test equipment targeting 5G and HPC is expected to be high.

Assembly and packaging equipment grew by 30% last year to about $38 billion. It is expected to grow by 8% this year to exceed 40 billion dollars, and to reach about 42 billion dollars next year. Demand for new equipment is increasing with the evolution of next-generation packaging technology and wire bonding technology.

The semiconductor material market is also expected to grow continuously. The wafer fab material market is expected to grow 5% this year to $56 billion, and $58 billion next year. In particular, it was found that the demand for photomasks, wet chemicals, photoresist, and anthracite is steadily increasing.

In particular, the demand for substrates used in next-generation devices for 5G and HPC among packaging materials is growing rapidly. Substrate is expected to increase by 8% from the previous year to $8.3 billion. In particular, flip chip-ball-grid array (FC-BGA), TSMC’s chip-on-wafer-on-substraight (CoWoS), ASE’s fan-out-chip-on-substraight (FOCoS), Amkor’s substrate -SWIFT is expected to drive growth.

SEMI predicts that Taiwan will make the highest investment over the next two years by region. Taiwan is expected to spend $19.9 billion on semiconductor equipment investment this year and $21.2 billion next year. Next, Korea is expected to make the second largest investment with $18.9 billion this year and $20.7 billion next year.

“By the second quarter of this year, 200mm foundry production will be very tight,” said Crack Tseng, a researcher on the global semiconductor supply shortage.

Copyright © The Elec, the electronic component specialty media Unauthorized reproduction and redistribution are prohibited.