Increased capital income tax for multi-homed people in the area subject to adjustment and added a requirement for a period of stay to the special deduction for long-term holding

Establishment of integrated investment tax credit, collectively expanding the tax credit carry-over and deduction period to 10 years under the Special Act

Accelerated amortization special case for facility investment, applied for one year until the end of next year

Foreign tax transfer deduction period, expanded from 5 years to 10 years… Allowance of deduction of undeducted monthly amount

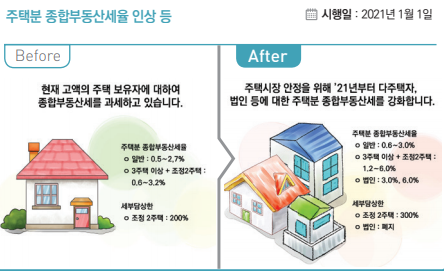

From next year, the comprehensive real estate tax rate for multi-homed people and corporate housing and the capital gains tax rate for multi-homed people in the area subject to adjustment will increase significantly. In particular, when calculating the number of houses for capital gains tax, the right to sell is also included, and the requirement for a period of residence is added to the special deduction for long-term holding of one household, one house.

Corporate support measures such as the establishment of the integrated investment tax credit, the extension of the carry-over deduction period for all tax credits under the Restriction of Special Taxation Act to 10 years, and the application of a one-year limited-time special case for accelerated amortization for facility investment are also notable.

On the 28th, the Ministry of Strategy and Finance published a booklet titled’Systems that will change from 2021′, which summarizes the system and regulations of each ministry that will change from next year.

First of all, the comprehensive real estate tax rate for multi-homed people and corporate housing will increase further. First of all, the tax rate for individuals with two or less houses is increased by 0.1 to 0.3 percentage points. Depending on the tax base, the current 0.5% to 2.7% tax rate rises to 0.6% to 3.0%. A single tax rate of 3.0% is applied to corporations with two houses or less.

For individuals with three or more houses or two houses in the area subject to adjustment, the tax rate is raised to 0.6% to 2.8% points. Depending on the tax base, it goes up from 0.6% to 3.2% to 1.2% to 6.0%. A 6% single tax rate is applied to corporations with more than 3 houses or 2 houses in the area subject to adjustment.

The upper limit for detailed charges is also raised. The application of the upper limit on sub-bills for corporate housing will be abolished, and the upper limit for sub-deductible payments for 2 homeowners in areas subject to individual adjustment will be increased from 200% to 300%. In particular, the comprehensive real estate tax deduction of KRW 600 million will be abolished for corporate-owned houses.

However, the limits of the tax deduction rate and the combined deduction rate for the elderly who own one household and one house will be raised to reduce the burden on the actual residents. Accordingly, the deduction rate for the elderly aged 60 or older is raised by 10%p by age. Those over the age of 60-65 increase from 10% to 20%, over the age of 65 to 70, 20% to 30%, and over the age of 70 30% to 40%. The long-term holding deduction and the combined deduction will also increase from 70% to 80%.

Capital gains tax is also strengthened. First of all, from next June, the capital gains tax rate on houses held for less than two years (including the right to move in and sale for members) will increase. For houses held for less than one year, the previous 40% to 70%, and for houses held for less than one or two years, a transfer tax rate of 60% is applied from the previous basic tax rate. In particular, a 60% heavy tax rate is applied even if the right to pre-sale is held for more than two years.

The capital gains tax rate for multi-homed people in the area subject to adjustment will also increase. The basic tax rate + 20%p is applied for 2 houses and 3 or more houses the basic tax rate + 30%p.

In particular, newly acquired sales rights from January 1 of next year are included in the number of houses when determining whether there is a single homeowner in one household or a multi-homeowner in the area subject to adjustment.

In addition, when a corporation transfers a house, the additional tax rate is increased from 10% to 20% in addition to the corporate tax rate (10-25%). The additional tax rate upon transfer is also applied to the right to acquire a house owned by a corporation (right to move in as a member of union, right to sell in lots).

In addition, the period of residence is added to the requirements for applying the special long-term deduction for one-family house (actual transaction exceeding 900 million won). The deduction rate, which was 8% per year for the holding period, will be adjusted to ‘4% retention period + 4% residence period’ from houses transferred after January 1 of next year.

On the other hand, the corporate support tax system to overcome Corona 19 and support economic vitality will be strengthened.

First, an integrated investment tax credit will be established. Accordingly, the investment tax credit for nine specific facilities and the investment tax credit for SMEs are integrated. The key to the integrated investment tax credit is the expansion of assets subject to tax support, incentives for investment growth, and preferential treatment for investments related to new growth technologies.

It is applied from those who report income tax and corporate tax after January 1, 2021, but for investments in 2020 and 2021, companies can choose the advantageous one between the integrated investment tax credit and the investment tax credit for existing specific facilities.

In addition, under the Restriction of Special Taxation Act, the carry-over deduction period for all tax credits is extended to 10 years. Currently, deductions are carried forward for 5 years, except for some tax deductions for R&D expenses for new growth source technologies, but the carry-over deduction period has been extended to 10 years for all tax deductions collectively.

The special case of accelerated amortization for facility investment is applied for one year until the end of next year. The reported useful lives within the range of 50% (large companies) and 75% (mid-sized and small and medium-sized companies) of the standard useful life are applied.

Transfer gains are not taxed when investing in materials, parts and equipment SMEs such as venture capital. It is subject to acquisitions such as investment from January 1st next year to December 31st, 2022.

The investment and win-win cooperation promotion tax system is redesigned and the application period is extended by two years. The share of investment-inclusive corporate income will be adjusted from 65% to 70%, and the target for wage increase for regular workers will also increase from 70 million won to 80 million won in total salary. The carryover period of excess reflux is also increased from one year to two years.

In addition, in order to reduce the double taxation burden of domestic companies in overseas markets, which are in trouble due to the Corona 19 crisis, the period for the carry-over of foreign tax payments was extended from 5 to 10 years, while allowing the inclusion of deductibles of the amount not deducted. Accordingly, if the amount of foreign tax paid that has not been deducted during the carryover deduction period (10 years) remains, it can be included as a deductible in the year following the end of the carryover deduction period.

In addition, tax support will be created for investors of New Deal Infrastructure Fund and investors who have invested in investment loan funds under the Private Investment Act on Social Infrastructure.

Investors in investment loan funds are taxed separately at a rate of 14% on dividend income from the limit of KRW 100 million, and investors in New Deal infrastructure funds are taxed at a rate of 9% from the limit of KRW 200 million.