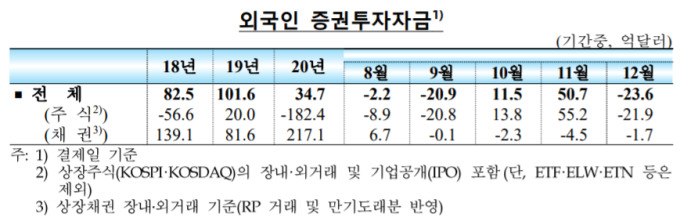

[서울=뉴스핌] Reporter Baek Ji-hyun = Foreign securities investors have turned their net outflows in three months. Net outflows of stock funds turned into net outflows due to the sale of profit-taking by foreign investors, and net outflows of bond funds decreased due to inflows of private funds.

According to the Bank of Korea on the 8th, in December 2020, foreign domestic securities investment funded net outflow of $2.36 billion. Net repayment of $1.15 billion in October and $5.07 billion in November for two consecutive months, but the net outflow turned back.

|

| [자료=한국은행] |

Among them, stock funds were net outflow after 3 months of $2.19 billion due to the sale of profit-taking. The net outflow of bond funds was 170 million dollars. Despite the large-scale repayment to maturity, the amount of net outflow decreased from November ($450 million) due to the inflow of private funds due to the expansion of arbitrage incentives.

The dollar/won exchange rate fell from 1106.5 won at the end of November to 1086.3 at the end of December to 1085.6 won as of January 6. Although it temporarily rebounded due to the spread of Corona 19 in Korea, it fell due to a weak dollar, a surplus in Korea’s current account, and a rise in domestic stock prices. The volatility of the won/dollar exchange rate in December was 3.5%, which was down from 4.1% in the previous month.

The dollar/won swap rate (3 months), which represents the bank’s foreign currency loan demand, was -9bp (1bp=0.01%p) on the 6th of this month, down 24bp from November. An official from the BOK explained, “The banks’ conservative fund management to manage the regulatory ratio at the end of the year and institutional investors’ demand for foreign currency funds for overseas investments led to a sharp decline. Since the year-end factors were resolved, the decline narrowed.”

The currency swap rate (3 years) fell 4bp to 25bp. It temporarily declined and then rebounded, affected by the swapping movement.

Domestic banks’ mid- to long-term foreign currency borrowings, indicating the foreign currency borrowing conditions, declined and improved. It fell 18bp MoM from 33bp in November to 15bp in December. The CDS premium for external bonds fell 1bp to 21bp, falling for the second consecutive month.

The average daily foreign exchange transaction volume between domestic banks was $2.64 billion, a decrease of $520 million from the previous quarter. This is mainly due to the $720 million drop in spot exchange transactions.