Input 2021.03.26 22:39

On the 30th, Korea & Company will compete for a sibling vote over the appointment of the audit committee member at the shareholders’ meeting on the 30th.

Vice-Chairman Cho, Nam-in, the eldest, recommended Lee Han-sang, a professor in the Department of Business Administration at Korea University, as an outside director and a member of the Audit Committee through a shareholder proposal. On the other hand, the largest shareholder, Cho Hyeon-beom, president of Nam Cha Nam and the board of directors of Korea & Company, have appointed Kim Hye-kyung, former Blue House female family secretary, as outside directors and audit committee members.

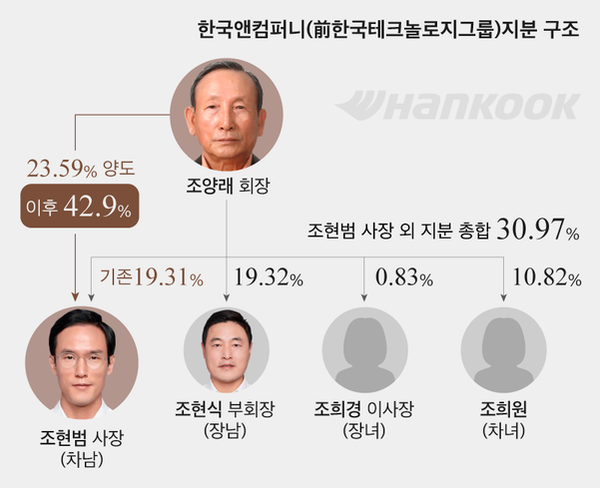

As for the stake structure, Vice Chairman Cho is pushed to President Cho. Currently, Korea & Company’s shares consist of ▲President Hyun-beom Cho 42.90% ▲Vice-Chairman Cho Hyun-sik 19.32% ▲Second daughter Jo Hee-won 10.82% ▲Chairman Jo Hee-kyung 0.83%. The combined share of Chairman Cho, who is friendly to Vice Chairman Cho, is only 20.15%.

However, competition became possible under the ‘3% rule’ of the amendment to the Commercial Act passed by the National Assembly at the end of last year (restricting the voting rights of the controlling shareholder to a maximum of 3% when selecting an auditor of a listed company). This is because both President Cho and Vice Chairman Cho have voting rights limited to 3%, so securing the votes of minority shareholders is the most influential. Since the decision of the national pension can affect the judgment of minority shareholders, the industry has been paying attention to the decision of the national pension. Korea & Company’s minority shareholders’ ownership is 22.61%.

The conflict between the Hankook Tire family began in June of last year when the youngest son Hyun-beom Cho, president of Hankook Tire & Technology, took over 23.59% of his father, Yang-rae Cho, chairman of Korea & Company through overtime mass trading, and increased the stake in Korea & Company to 42.90%. A month later, in July of last year, the eldest daughter, Chairman Cho, asked the Seoul Family Court to judge Cho Yang-rae for adult guardianship, saying, “It is necessary to judge whether the father is a voluntary doctor from a healthy mental state.” Vice-Chairman Cho also participated in this.

The commission also opposes the agenda of the appointment of Cho Hyun-beom as the executive director of Hankook Tire’s stockholders’ agenda. The trustee said, “We decide on the objection on the grounds of the history of damage to corporate value or infringement of shareholder rights and interests.”