The Ministry of Health and Welfare will hold the 3rd National Pension Fund Management Committee on the 26th to deliberate on a review plan for the national pension fund management rebalancing system. Rebalancing refers to adjusting the ratio of investments in assets such as domestic stocks, foreign stocks, and domestic bonds. Each year in May, the asset investment ratio for the next year is confirmed, and it is very unusual to discuss rebalancing in the middle. So, it is pointed out that the national pension was a white flag against the pressure of domestic individual investors called’Donghak ants’.

Ministry of Welfare, fund management committee held tomorrow

Discussing the investment method of assets such as stocks

Pointing out “election ceremony” in unusual meetings

Expert “must adhere to the principle of investment independence”

The National Pension Service net sold domestic stocks (approximately 15 trillion won) for 51 trading days from December 24th to 11th of last year, and this has been criticized by individual investors for adversely affecting the stock price.

There are two reasons for the sale of the National Pension Plan. An official from the Fund Management Division said, “The principle is to sell the national pension when the stock price is good and buy it when the market is not good. Only by realizing the profits in this way can the old capital of the people be preserved.” They followed the logic of the fund.

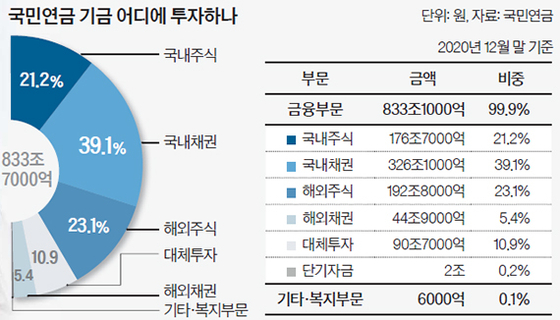

Where to invest in the National Pension Fund

Another reason is the asset allocation ratio. The Ministry of Health and Welfare meets the Fund Management Committee every May to determine the mid-term asset allocation plan for the next five years and the asset allocation ratio for the next year. In May of last year, the ratio of domestic stocks in 2021 was set at 16.8%. It also decided to lower the domestic stock ratio to 15% by 2025.

However, the share of domestic stocks rose to 21.2% in December last year as stocks that had collapsed in the early stages of the novel coronavirus infection (Corona 19) surged. It exceeded the target for the end of 2020 (17.3%) set by the Fund Management Committee in May 2019, and far exceeded the target for this year (16.8%). Sold to match this.

As the criticism increased, Minister of Health and Welfare Kwon Deok-cheol came out from the 2nd Fund Management Committee on the 24th of last month. I decided to report above.” The Ministry of Health and Welfare said on the 18th that “there is no plan to discuss the target ratio of asset allocation,” and it is expected that it will not raise the target for the share of domestic stocks at the meeting on the 26th.

Instead, it seems that the tolerance range will be adjusted. Currently, the’target (16.8%)±5%’ is the allowable range. It consists of strategic allocation and tactical allocation, and there is a high possibility of adjusting the ratio of the two. In this case, it seems that the proportion of domestic stocks is increasing. The Fund Management Committee may gather opinions to expand the allowable range (±5%).

It is rare for the government to adjust the weight and tolerance of each asset. The share of assets by asset has never been in the middle since the 2008 global financial crisis, and the tolerance range has never been in the middle since 2011. Some have pointed out that the mediation is ahead of the 4·7 re-and by-election election.

Seok-Myung Yoon (Research Fellow, Korea Institute for Health and Social Affairs), Chairman of the Korea Pension Service, said, “A matter such as rebalancing should be discussed as a formal agenda when the Fund Management Committee determines the asset allocation plan every May. If you change it to, it will give you a bad signal that you can do this.” Chairman Yoon said, “We must show the principle that the national pension is responsible for guaranteeing the people’s retirement income while maintaining independence from social and political pressures.”

Won-sik Kim, professor of economics at Konkuk University, said, “The National Pension seems to play a zero-sum game with individual investors. Because domestic stocks are risky assets, I would like to refer to the case of investing only 2-3% in domestic stocks and investing abroad, like in Canada.

Welfare reporter Shin Seong-sik [email protected]

![]()