The entry of new players is expected to accelerate to lead the competition and innovation of the insurance industry.

In addition to the existing face-to-face recruitment, insurance recruitment regulations suitable for the digital environment will be improved.

The Financial Services Commission announced today (1st) the policy direction for trust and innovation in the insurance industry.

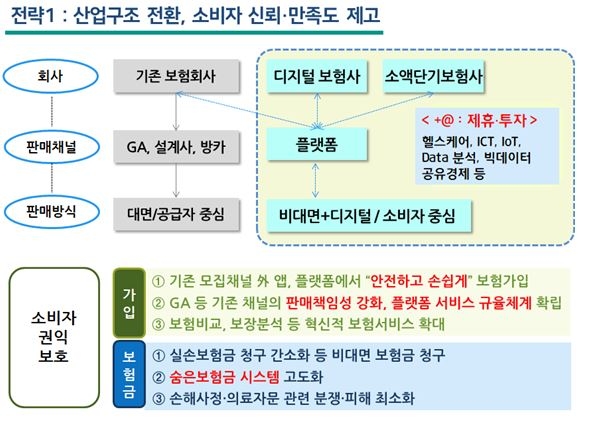

The four strategies for the insurance industry suggested by the Financial Services Commission are ▲ improving the industrial structure and enhancing consumer confidence and satisfaction ▲ strengthening the social safety net function ▲ promoting digital innovation in the insurance industry ▲ improving the management and culture of insurance companies.

◆ The speed of digitalization of insurance

First, in order to promote innovation in the insurance industry, it was decided to activate the new licenses of micro-insurance, also known as mini insurance companies and digital insurance companies.

To this end, the Financial Services Commission eased the capital requirements of mini-insurers to KRW 2 billion and set standards such as items handled, insurance period, and income insurance premiums. There is a plan to hold a briefing session for this permission next month.

Following Kyobo Life Planet and Carrot Insurance, digital insurance companies also decided to grant additional licenses. Currently, Kakao is examining the preliminary permission.

In particular, considering the introduction of the small-term insurance business and the management and business structure restructuring of insurance companies in response to environmental changes, a new licensing policy was decided in the first half of this year.

Previously, only one life insurance and non-life insurance were permitted for each subsidiary and financial group, and multiple licenses were exceptionally granted only when the sales channel was separated. The plan is to prepare a plan for flexibility through research services in the first half of this year.

In addition, regulations will be improved to promote non-face-to-face recruitment. Currently, the designer is obligated to meet the customer more than once, but if the important matters are explained over the phone and safety devices such as recording are premised, a plan is being promoted to exempt them.

Insurance recruitment through video calls, etc. is also allowed, and the inconvenience of having to repeatedly sign multiple times on a small mobile phone screen after listening to a designer’s explanation by a consumer is solved, and the insurance subscription process is improved so that only once electronic signature is signed.

In addition, it is expected that a hybrid recruitment method in which AI voice bots instead of humans can fulfill the duty of explaining the phone, solicit and explain the product over the phone, but sign the subscription by mobile is also expected.

In the first half of this year, a clear standard was proposed and appropriate consumer protection devices were set up to enable the sale of insurance products through online platforms.

The requirements for entry into agencies will also be improved so that platform operators engaged in recruiting can provide services with legal recruitment qualifications.

◆ Advancement of consumer protection devices

For products that are highly likely to be sold incompletely and are likely to be damaged by consumers, alert consumers and strengthen sales procedures.

For example, in order to prevent damage to consumers due to incomplete sales for foreign currency insurance, which has recently increased in sales, on-site inspection and model standards have been established.

Insurance products with new insurance premium exemption conditions have been improved to undergo deliberation by the new product development consultative body.

In particular, in the stage of signing an insurance contract, it was decided to strengthen sales responsibilities to block incomplete sales of insurance agencies (GA).

The 1,200% rule (restricting the recruitment fee for the first year of the contract to less than 1,200% of the monthly premium for the first year of the contract) to improve the prepayment of excessive recruitment fees is a policy to curb unhealthy business incentives.

In addition, we will introduce incentives for excellent GA and a penalty for replacing business suspension to prevent damage to good designers.

The core of the insurance payment stage is computerized medical insurance claims. The Financial Services Commission plans to continue to pass a bill to computerize indemnity claims in order to alleviate the inconvenience of about 38 million injured subscribers.

The system is also upgraded so that consumers can directly claim insurance benefits in the hidden insurance payment inquiry system.

◆ Injury/Auto Insurance Restructuring… Insurance premium burden↓

It was also decided to rationalize insurance premiums for indemnity medical insurance and auto insurance, which the majority of citizens subscribe to.

Earlier, the Financial Services Commission introduced a fourth-generation “pay what you spend” in order to lower the premium burden of real loss insurance. In the first half of this year, new products will be released in July after revising the insurance industry supervision regulations.

In the case of automobile insurance, in order to solve the problem of increasing insurance premiums due to over-treatment, it has decided to improve the treatment cost compensation system for minor injuries (injury grades 12-14) in the second half of this year.

As of last year, the insurance amount per person with minor injuries was 1.79 million won, a 42% increase from 2016. The Financial Services Commission decided to review a plan to treat the negligence portion of the treatment expenses for minor injuries with their own insurance after going through a process for collecting opinions such as a public hearing.

In addition, a plan to make it mandatory to submit a medical institution’s medical certificate is under review if a minor patient is being treated beyond the normal treatment period.

Kwon Dae-young, head of the Financial Industry Bureau of the Financial Services Commission, said, “We will strengthen the rights and interests of many good contractors by reflecting the reduction of the loss ratio resulting from the improvement of the system in the calculation of premiums.”

◆ Customized insurance for aging is poured out

In order to enhance the role of the insurance industry against social structural risks such as aging, the 4th industrial revolution, and disasters, the’Insurance Industry Private Safety Net Strengthening TF’ is also operated.

In particular, the plan is to revitalize pensions, insurance specializing in senior citizens, and insurance exclusively for chronically ill patients using health data to support stable retirement life for the elderly.

In addition, it was decided to establish a system to ease the burden of insurance premiums for platform workers, such as agents and delivery workers, and to review product activation.

For example, it is planning to further revitalize the’on-off’ type of insurance, which sets and charges insurance premiums only during delivery, which has recently been partnered with the nation of delivery and KB Insurance.

In addition, it has decided to provide support for the supply of compulsory insurance that was introduced to guarantee safety in various parts of society, such as cyber insurance that can be guaranteed during electronic financial transactions and self-driving cars, and continue to improve product structures such as coverage and insurance premiums.

◆ Active use of big data and AI

In order to activate data-based customized insurance, designation of innovative services and system improvement are also carried out.

In particular, the Financial Services Commission’s position is to actively designate a financial regulation sandbox for innovative insurance services using the Internet of Things or wearable devices.

The plan is to establish an innovative insurance product activation TF to review the impact of non-traditional insurance allowed through the regulatory sandbox, and to actively institutionalize if there are no side effects.

In addition, by allowing insurance companies to own my data providers as subsidiaries, it will accelerate the convergence of financial and non-financial data, and support the development of customized insurance products for chronically ill and sick people using health and medical data.

In addition, it supports insurance companies to establish a comprehensive life finance platform through entry into the My Data business and alliances with healthcare and ICT companies. It is explained that it actively supports the use of data on health and illness, in addition to data related to loss ratio and insurance payment of existing insurance companies.

The target of existing insurance companies’ healthcare service provision is also expanded from existing contractors to’the general public’, and subsidiary ownership is also allowed so that insurance companies can actively invest in digital healthcare startups.

In addition, the Financial Services Commission decided to advance the insurance accounting system for a soft landing of the new international accounting standards and redesign incentives to stimulate ESG management and investment in the insurance industry.

In addition, the plan is to improve the insurance industry’s short-term performance focus by improving the compensation system by extending the management’s performance fee deferral period from the current three years.