Loans for SMEs and small business owners will be extended for another six months until the end of September. Even after the maturity extension measures are over, repayment methods and deadlines can be adjusted in consultation with financial institutions such as banks. Although this is an inevitable measure due to the novel coronavirus infection (Corona 19), voices of concern about poor loans, etc. come from the financial sector.

Afterwards, repayment method and period are negotiated and adjusted

KRW 130 trillion in maturity extension and interest deferred

The authorities say there is no problem with the health of the bank,

Financial sector “is likely to become insolvent in loans”

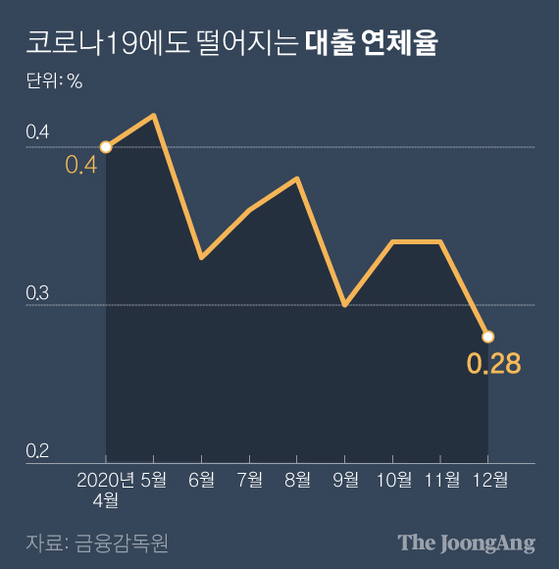

Loan delinquency rate falling even in Corona 19. Graphic = Reporter Park Kyung-min [email protected]

The Financial Services Commission announced on the 2nd that “in consideration of the difficulties of small and medium-sized business owners, it was decided to extend the loan principal repayment maturity and interest repayment deferral measures by six months, as it was previously.” Accordingly, SMEs and small business owners who have been directly or indirectly damaged by Corona 19 can apply for an extension of the maturity of loans in the financial sector and a delay in repaying principal and interest until the end of September. However, there should be no insolvency such as delinquency of principal and interest, encroachment on capital, or closure of business. Even if you have already applied for an extension of maturity or deferral of repayment, you can reapply. The deadline for extension of maturity is 6 months from the date of application. For example, if you apply for a maturity extension in May this year, the loan maturity will be extended until November.

According to the Financial Services Commission, as of the end of last month, the total amount of extension of maturity and deferment of interest repayment in the financial sector was 130 trillion won. The maturity extension is the largest with 121 trillion won (371,000 cases), with 9 trillion won (57,000 cases) deferred in principal repayment, and 163.7 billion won (13,000 cases) deferred in interest repayment. In the case of deferment of interest repayment, the size of the principal is estimated at 3.3 trillion won.

Loan maturity extension and interest repayment postponement status. Graphic = Reporter Park Kyung-min [email protected]

Until now, the financial sector has been struggling with such measures. A bank official said, “At the request of the financial authorities, they agreed to extend the delay in repayment of interest, but loans with delayed interest are highly likely to become insolvent.” On the other hand, financial authorities are in the position that even if interest repayment is postponed, there will be no major problems with bank soundness.

According to the Financial Supervisory Service, as of the end of December last year, the delinquency rate of Korean banks’ loans in Korean won (delinquency of principal and interest for more than one month) was 0.28%, down 0.07 percentage points from the previous year, the lowest since the statistics were prepared in 2007. However, some point out that such an indicator of soundness is an’optic illusion’. It is pointed out that while the total amount of loans (denominator) increased, the delinquency of principal and interest was reduced through delays in repayment of interest.

In the report, Kim Jeong-hoon, a senior analyst at Korea Credit Rating, pointed out that “the plan to flexibilize financial regulation always follows the optical illusion of soundness indicators.” “The soundness indicator is the lowest ever, and there is a big gap with the real economy.” Some also raise the possibility that the soundness index will deteriorate at a time when interest deferrals and the like are terminated.

Regarding this, Kwon Dae-young, head of the Financial Industry Bureau of the Financial Services Commission, said, “I agree that the delinquency rate can cause an illusion,” and said, “Financial companies have accumulated enough provisions preemptively and will continue to manage soundness in the future.”

On the same day, the Financial Services Commission also announced a plan for a soft landing with a delay in repayment. The purpose of this is to reduce the difficulties that will be experienced due to the lump sum of principal or interest to be paid after the grace period is over. The main goal of a soft landing plan is to have the borrower who borrowed the money decide the repayment period and method after consulting with a financial company.

For example, if a borrower who repays the principal and interest repayment in installments of 5% (fixed) on the loan of 60 million won and the principal of 5 million won per month with a remaining maturity of 1 year, the existing loan maturity is tripled (1 year and 6 months). It is also possible to pay off the installment amount of the principal by extension (2.5 million won) plus the existing interest and deferred interest.

Reporter Ahn Hyo-seong [email protected]

![]()