In response to the financial authorities’ warning of’debt investments’, banks are putting out measures one after another, such as reducing the limit on loans and raising interest rates. In the aftermath of the rise in market interest rates, the interest rate on mortgage loans, which is linked to this, is also continuing to rise, causing the interest burden on individuals to jump dramatically.

K Bank also raises the credit rate

According to the banknote on the 28th, K-Bank increased the interest rates of credit loans for office workers and loans for’minus bankbooks (limit loans)’ by 0.2 percentage points and 0.1 percentage points (based on the lowest interest rate), respectively. The minimum interest rate for credit loans has been raised from 2.44% per annum to 2.64% per annum, and the minimum interest rate for negative bank loans has been raised from 2.9% per annum to 3.0% per annum.

K-Bank explained that the decision was made in light of the fact that other banks are reducing the limit or removing preferential interest rates to regulate the pace of household loans, which have been increasing rapidly since last year. On this day, Woori Bank reduced the limit of 10 products such as’our main business employee loan’,’our special loan’,’our first salary credit loan’, and negative bankbook to 50 million won. Hana Bank has also started to raise interest rates by removing 0.1 percentage points from the preferential interest rate applied to the’Hana OneQ Credit Loan (Excellent)’ product, which is a high-credit loan.

The reason that the banks started to’tighten their loans’ is because the pressure from the financial authorities has increased. It is reported that the Financial Supervisory Service convened the vice presidents in charge of loans at 17 banks on the 26th, held an emergency inspection meeting, and ordered to “manage the previously submitted household loan plan well.”

Until last year, financial authorities mainly targeted the top five banks. However, as the stock market boom and IPO subscription subscriptions overlapped, the’balloon effect’ of consumers flocking to non-face-to-face loans from less regulated internet specialized banks appeared, and it began to affect internet specialized bank loans. An official from the bank said, “K-Bank had a’normal consideration’ in various regulations due to the suspension of loans for about a year, but the atmosphere has changed recently.” On the 22nd, Kakao Bank also reduced the maximum limit on credit loan products for high-credit office workers from 150 million won to 100 million won.

‘Interest rate rises more’ common people’s anxiety

Banks explained that the recent rise in interest rates on short-term financial bonds used to calculate credit loans has made a rate hike inevitable. As of this day, the 6-month interest rate for financial bonds was 0.82% per year, up 0.13 percentage points from 0.69% per year on August 28 last year. It is analyzed that as measures to eliminate various preferential interest rates have been added to this, the real interest rate that consumers feel has increased.

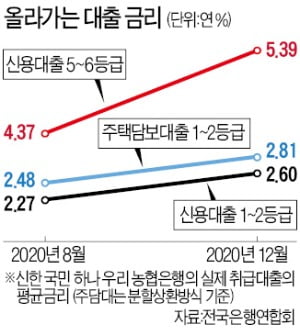

According to the Federation of Banks, in December last year, the average interest rate of credit loans from five major banks, including Shinhan Kookmin Hana Woori Nonghyup, to consumers with ratings 1 and 2 was 2.60% per year. It rose 0.33 percentage points in four months from 2.27% per year in August of last year. The average interest rate for grade 5-6 credit loans rose 1.02 percentage points from 4.37% per year to 5.39% per year over the same period. As the financing rate rises, the risk factor increases and the interest rate for low-credit people jumps more rapidly.

During the same period, interest rates on mortgages also rose slightly. The interest rate for mortgage loans based on the amortization of principal and interest handled by the five major banks rose from 2.48% per year in August last year to 2.81% per year in December.

An official from the bank said, “The financial authorities’ measures not to give loans to high creditors and the rise in market interest rates are having a greater impact on the common people.” It’s likely to be bigger,” he said.

Reporter Daehoon Kim/Hyunah Oh [email protected]