Loan regulation and U.S. government bond surge

40% DSR for each borrower

(Graphic = Reporter Son Mi-kyung sssmk@)

Commercial bank loan interest rates have risen 0.6 percentage points (p) in the last six months. This is due to the combination of financial authorities’ lending regulations and the surge in US Treasury yields. Accordingly, it is expected that the burden on the young-cle (by attracting to the soul and investing) and debt (investing by debt) will increase.

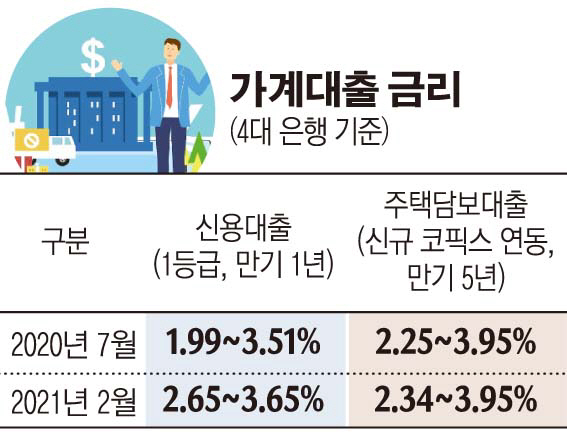

According to the financial sector on the 1st, KB Kookmin, Shinhan, Hana, and Woori Bank’s one-year credit loan interest rate for the first class as of the 25th of last month is 2.59~3.65% per year. Compared to the level of 1.99~3.51% at the end of July last year, it is up 0.14~0.6%p. The weighted average interest rate for household loans announced monthly by the Bank of Korea is also on the rise. The average interest rate for household loans based on the new amount handled was 2.83% in January this year, rising for 5 consecutive months since last August (2.55% per year). During the same period, the average interest rate on credit loans rose 0.5 percentage points from 2.86% to 3.46%.

The same goes for the rise in mortgage interest rates. As of the 25th of last month, the interest rate for home mortgage loans linked to Cofix is 2.34~3.95% annually for the four major banks (KB Kookmin, Shinhan, Hana, and Woori Bank). Compared to the 2.25~3.95% in July of last year, the minimum interest rate rose by 0.09%p.

The rise in interest rates is interpreted by pressure from financial authorities and rising US Treasury yields. Since last year, banks have started to manage credit by reducing preferential interest rates or reducing the limit on loans in response to the financial authorities’ words to reduce household debt. In addition, as interest rates on U.S. Treasury bonds surged, interest rates on government bonds in major countries rose, and even our loan interest rates have jumped.

As interest rates rise, the interest burden on new loan holders as well as those with existing loans is expected to increase. Credit loans and variable-rate home mortgage loans are the reason that interest rates are adjusted again after a contracted period of 3-6 months.

The Financial Services Commission plans to announce a strengthened total debt repayment ratio (DSR) policy in next month to manage the increased burden on household debt. DSR is an index that judges the repayment burden relative to income by considering the principal and interest of all financial sector loans such as mortgage loans, credit loans, and card loans when financial institutions review loans.

The FSC’s household debt management plan is to apply DSR 40% to each borrower collectively. In the past, banks only had to manage 40% of the DSR for all customers combined, so some borrowers could receive loans with a DSR of more than 40%. However, as management plans are announced next month, most financial consumers are unlikely to receive loans exceeding 40% DSR.

However, the Financial Services Commission plans not to retroactively apply 40% of DSR to borrowers who received loans prior to the application of the regulations. In addition, considering the relatively low-income youth, it is expected to apply a more relaxed standard than 40%.