It was found that the credit balance of the five major banks, which had increased rapidly until last month, has decreased by more than 400 billion won this month. As the stock market’s uptrend in recent years has waned, an analysis shows that the’debt investment’ fever has somewhat subsided. In accordance with the policy of the financial authorities to tighten household loans, the effect of raising the loan rate and lowering the limit for each bank was also added. There are also complaints among end users of loans that’the threshold of credit loans is too high’.

Credit loan balance decreased by 440 billion won in February

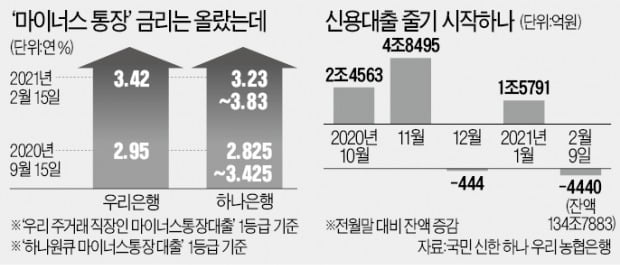

According to the financial industry on the 15th, the credit loan balance of the five major banks, including Shinhan Hana and Woori Nonghyup, as of the 9th was 134.788.3 billion won, a decrease of 44.4 billion won from the end of last month. This means that financial consumers have paid more credit than new loans this month.

Last year, credit loans were fueled by the’debt throw’ fever in the real estate and stock markets. After the Corona 19 incident, funds flowed into the stock market and real estate, breaking the highest monthly increase twice last year in August (4.704 trillion won) and November (4,849.5 trillion won).

In December, as banks temporarily raised the loan threshold, the five major banks’ credit loans decreased by 44.4 billion won compared to the previous month. However, the decline was short-lived. This year, the KOSPI index exceeded 3200, and debts increased as the’stock market rally’ appeared, and the balance of credit loans rose to 1.5791 trillion won for a month in January.

Then, the Financial Supervisory Service demanded that banks be guilty of “minus bankbooks (limited loans),” saying that excessive debt investment should be prevented. Last month, Shinhan and Woori Bank reduced the limit on negative bank accounts by 50 million won. Internet banks such as Kakao Bank and K-Bank have also reduced the limit on loans for office workers and raised interest rates. An official from a bank explained that “the effect of the stock market’s recent slowdown and the result of raising the threshold of negative bank accounts gradually appear.”

End users complain about’the threshold is too high’

The debt investment phenomenon has slowed somewhat, but dissatisfaction from end users of loans continues. Compared to last year, the credit limit has been markedly reduced and interest rates have increased. Mr. Kim (36), an office worker, said, “I was very embarrassed to find out that Kakao Bank’s negative bankbook last month, and that the limit was only 20 million won. “The situation where you have to break the savings and savings in front of you.”

Banks explained that the number of cases in which interest rates rose significantly when the negative bankbook contract was renewed. The minimum interest rate for KB Star’s negative non-face-to-face credit loans for high creditors (formerly 1st grade personal credit) of Kookmin Bank rose from 3.1% per year in September last year to 3.36% per year as of this day. Hana Bank’s Hana One Q negative loan interest rate rose 0.4 percentage points over the same period, and Woori Bank’s negative bankbook loan interest rates rose 0.47 percentage points. If you wrote a negative bankbook at an annual interest rate of 2% last year, and if you renewed the contract earlier this year, you have no choice but to feel that the interest rate has risen significantly.

A bank official said, “If you need money, it is advantageous to receive a lump sum credit loan (a case-by-case loan) with a slightly lower interest rate instead of a negative bankbook.” There are also views that the’fire’ of debt and credit loans has not been completely turned off. This is because it depends on the stock market situation and the authorities’ lending regulations. Next month, the Financial Services Commission is scheduled to announce a measure to completely change the total debt principal repayment ratio (DSR) regulation for each individual financial company. Accordingly, there is a possibility that the demand for the’last car’ to receive a loan when it is available will be driven.

Reporter Daehoon Kim/Soram Jung [email protected]

Ⓒ Hankyung.com prohibits unauthorized reproduction and redistribution