The deregulation period that the Financial Services Commission applied to financial companies such as banks is extended. This is a measure to keep the financial sector’s active role in supporting the real economy in the aftermath of the novel coronavirus infection (Corona 19).

On the 9th, the Financial Services Commission announced that it would extend the deadline for easing the bank’s LCR. Financial Committee

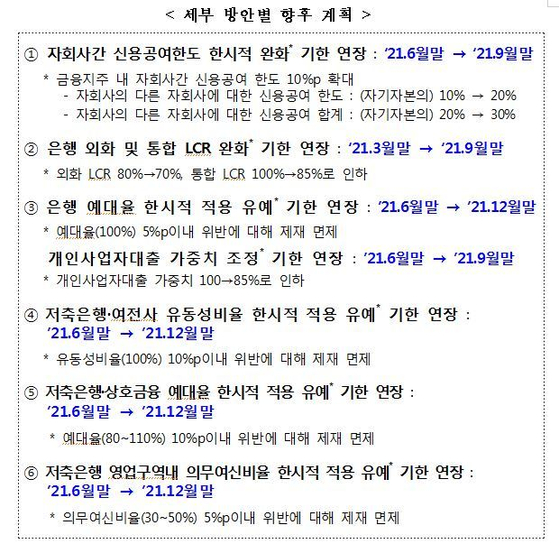

According to the Financial Services Commission on the 9th, the time limit for easing the bank’s circulating coverage ratio (LCR) will be extended from the end of this month to the end of September. Earlier, the financial authorities decided to cut the consolidated LCR from 100% to 85% and the foreign currency LCR from 80% to 70% by the end of this month. However, it was decided to extend the LCR mitigation period by six months, taking into account the extended period of expiration and deferred repayment measures and uncertainties related to Corona 19.

LCR is the ratio of obligatory holdings of assets that are easy to convert into cash, such as government bonds. In preparation for a liquidity crisis, banks must hold cash equivalents equal to at least a month’s worth of cash outflows. The higher the LCR, the better the liquidity crisis can survive.

Along with this, the relaxation of the bank’s loan-to-deposit ratio (deposit loan ratio), which was originally scheduled to end at the end of June, will be extended until the end of December. It is explained that the period of maturity extension measures and the necessity of giving financial companies a sufficient period of adaptation were considered.

Accordingly, there will be no penalties such as sanctions for violations within 5% points of the loan-to-deposit ratio until this year. In the case of banks, the standard deposit-to-deposit ratio is 100%, but the limit for the deposit-to-deposit ratio is increased to 105%. From the bank’s point of view, more loans can be made with the same deposit balance. For savings banks and mutual finance, it was decided to waive sanctions within 10% of the deposit-to-deposit ratio (80-110%).

An official from the Financial Services Commission said, “The specific timing and method of normalization will be decided by comprehensively considering the quarantine situation, the real economy, and the soundness of financial companies,” he said. “We will give stakeholders a sufficient period of adaptation.”

Reporter Jiyu Hong [email protected]

![]()