Small and medium-sized buildings, small officetels, knowledge industry centers, and shopping centers are often referred to as’profitable real estate’ because they can earn rental income. It is a different kind from residential real estate, which has a large margin in market price. Last year, interest in profitable real estate was relatively small. This is because tenants such as self-employed have struggled with the spread of the novel coronavirus infection (Corona 19), and housing prices have skyrocketed. However, as the market liquidity exceeds 3,000 trillion won and the corona 19 incident may be calmed down by the effects of vaccines this year, more and more investors are paying attention to profitable real estate.

Last year, the largest profitable real estate transaction such as the Little Building

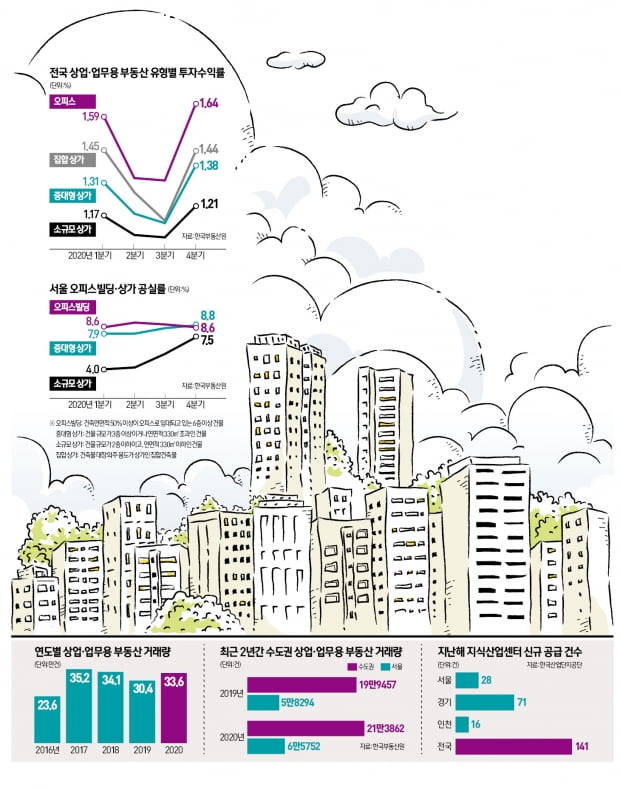

Last year, profitable real estate transactions were actively conducted nationwide. According to the Korea Real Estate Agency, in 2020, the nationwide commercial and commercial real estate transactions amounted to 33,5556 cases. Since 2017, for four consecutive years, the transaction volume has exceeded 300,000. In particular, the transaction of small and medium-sized buildings called’Little Buildings’ surged. According to One Building, a brokerage company specializing in small and medium-sized buildings, the transaction amount of small and medium-sized buildings (5 stories or less) in Seoul last year amounted to 22,307.7 billion won. Compared to 2019 (17,218.3 billion won), it increased by 5.89 trillion won, breaking the record high. The number of transactions was 2729, an increase of 699 from 2019 (2030).

One Building analyzed that the investment in the Little Building market has increased since the second half of last year when housing market regulations were strengthened. Oh Dong-hyup, CEO of One Building, said, “As the tax burden on high-priced houses and multi-houses increased last year due to the June 17 and July 10 measures, there has been an increase in demand to arrange all of them and purchase a small building.” “Amid the low interest rate, there are many investors who see it as stable even though the purchase price is high because the loan regulation is less than that of housing.”

Knowledge industry centers and shopping centers are also increasing interest

As venture and start-up startups increase, the knowledge industry center consisting of small offices and business facilities is also drawing attention. The knowledge industry center refers to a three-story or more complex building where companies and support facilities such as manufacturing, knowledge industry, and information and communication can be combined. The knowledge industry center is gaining popularity among profitable real estate in recent years because the implementer or owner can receive funding and tax support, and can invest in a relatively small amount.

The supply of knowledge industry centers has steadily increased over the past five years. As a result of analyzing the current status of the knowledge industry centers of the Korea Industrial Complex Corporation (as of the end of December 2020), Economic ManLab found a total of 141 new approvals for knowledge industry centers nationwide last year. This is the highest number since 1997, when the Korea Industrial Complex Corporation began to compile current status data. This is a 127% increase from 2015, five years ago. Dae-yeol Oh, head of the research team at Economic Man Lab, said, “The number of single or small companies has increased, and the demand for changeovers due to the aging of existing knowledge industry centers has increased.” “I am interested in a relatively free loan environment and tax reduction benefits.” did. However, team leader Oh stressed, “However, as the supply of knowledge industry centers increases, some sales performances are not good.” He emphasized that “the location, transportation environment, and product composition of the knowledge industry center should be considered rather than hasty investment.”

There is also an opinion that the time to invest in the malls that was hit hardest by Corona 19 last year is approaching. It is said that it is time to buy the net shopping mall at the lowest price due to the falling rights and trading prices. Dongguk University adjunct professor Ko Jun-seok said, “If vaccines are supplied and the Corona 19 shock is resolved, the shopping mall market will also revive,” and said, “It is the right time to invest in well-located shopping centers such as station areas and college districts.

“I think profitable interest will continue this year”

Experts predict that active investment will be made in the commercial and commercial real estate market this year as there is abundant circulating funds on the market. It is explained that commercial real estate will be able to reap profits due to the heavy duty of the transfer tax on multi-homed people, which will take effect from June. Won-sang Kim, CEO of WonLab, said, “For profitable real estate, the price decline is not large due to economic fluctuations, and steady profits are guaranteed, so transactions increase during the market downturn.”

The yield of real estate for business and profit is also on the rise. The return on investment of mid- to large-sized shopping centers fell from 1.31% in the first quarter of last year when Corona 19 began to 1.14% in the third quarter, and then slightly rebounded to 1.38% in the fourth quarter. Office buildings fell from 1.59% (first quarter of last year) to 1.32%, then recovered to 1.64%. According to the Korea Real Estate Agency, the value of all commercial real estate assets has risen due to the prolonged low interest rate, increased liquidity in the market, and the inflow of funds into the commercial real estate market due to housing market regulations.

Reporter Ayoung Yoon [email protected]