|

On the 20th, LG Electronics announced in an e-mail sent to members of the MC business division in charge of the smartphone business, saying,’We are carefully reviewing the direction of business operation by keeping all possibilities open for the MC division. LG Electronics’ share price rose 12.8% on the previous day as it was interpreted to be closing the smartphone business. This is because the market saw a good news for the cleanup of the business that had been in the red.

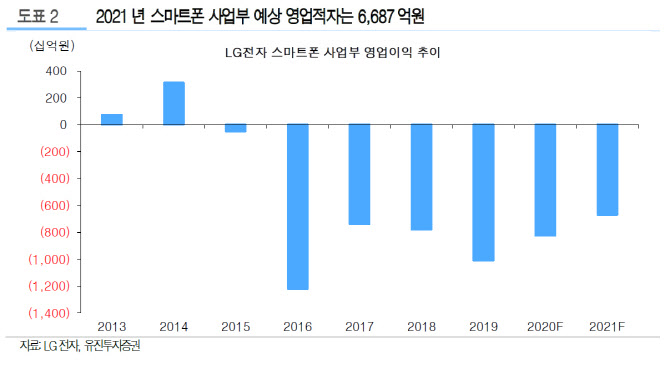

The MC headquarters was in charge of 23% of the company-wide consolidated sales with 13 trillion won in sales, but last year’s sales of 5.30 trillion won and the proportion decreased to 8.3% due to continued sluggishness and sales volume decline. The size of the operating deficit was an average of 800 billion won over the past four years, and the loss is expected to continue next year of 670 billion won.

Eugene Investment & Securities predicted that LG Electronics’ sales this year, assuming that the operating deficit of LG Electronics’ smartphone business will be resolved, declined 1.6% from the previous year to 62.3 trillion won. This is lower than the previous 67.3 trillion won. However, operating profit is forecast to rise by 18.4% from the previous 3,800 billion won to 4.5 trillion won. It is 40.9% higher than the previous year.

Gyeong-Tak Noh, a researcher at Eugene Investment & Securities, said, “The business deficit, which has been a significant part of the company, will be resolved through sales and restructuring in the future.” It is expected to increase.”

“The decision was made at the time of full-fledged growth of the electronics business, suggesting that the direction and speed of LG Electronics’ business strategy has changed from the past.” It is expected to secure global competitiveness through active investment in future industries such as autonomous driving and robots.”