[애널리스트 칼럼]-Present Choi, Director of Global Investment Information Center, Yuanta Securities

If you are an investor interested in stocks, you may have heard of a company called TSMC at least once. It can be said that Samsung Electronics has risen to national stock after the split-off, because Taiwan’s TSMC is a competitor that does not fall into the Samsung Electronics report. As Samsung Electronics’ semiconductor business has diversified from memory semiconductors such as DRAM and flash memory to non-memory semiconductors such as image sensors, 5G chips, and foundry businesses, competition with TSMC, the strongest in the foundry business, has become inevitable.

Although Taiwan has a population of only 25 million, it ranks 21st in the world in terms of gross domestic product (GDP), and is actually the third richest country in Asia after Japan and Korea. The source of this economic power can be found in the strong IT industry, led by TSMC. In the past, Taiwan competed with Korean companies in the memory semiconductor and display industries, but now the IT industry is formed centering on non-memory semiconductor foundries, post-processing, and outsourcing global IT products.

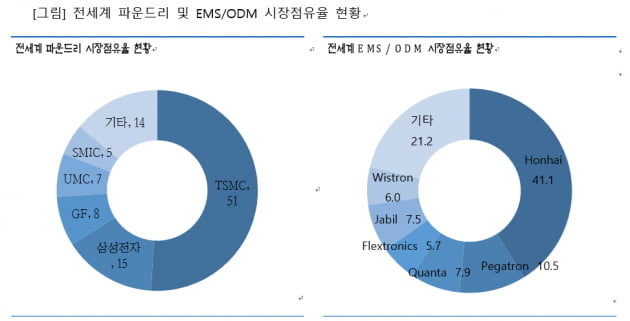

In the foundry market, TSMC holds an exclusive position with a market share of more than 50%. It monopolizes the AP production of Apple iPhone, and is in charge of the production of major global semiconductor companies such as Huawei, MediaTek, Broadcom and Qualcomm. Although Samsung Electronics has recently been actively investing in the foundry business, its market share is still in the second half of 10%, remaining in the second place with a gap with TSMC. Taiwan’s UMC also ranks fourth in the foundry market share. As of the end of 2020, TSMC’s market capitalization is 530 trillion won, exceeding Samsung Electronics’ 480 trillion won.

The growth of the foundry business in Taiwan inevitably led the growth of the semiconductor post-processing industry. Since most semiconductor companies except Intel and Samsung Electronics are in charge of design only (fabless), the foundry (semiconductor production) and post-processing (packaging and testing) industries will grow independently. ASE Tech, a Taiwanese packaging and testing company, is the number one company with over 30% of the global market share.

Along with the semiconductor industry, another axis that is leading the Taiwanese IT industry is the EMS (Electronic Product Manufacturing Service) industry. Paxcon and Pegatron are responsible for all iPhone production worldwide, and most of the notebooks sold worldwide are produced by Taiwanese companies. Accordingly, the overall supply chain of the IT industry is well established, and this infrastructure is the soil for the growth of Taiwan’s IT industry.

The reason why you should be interested in the Taiwanese IT industry is not just because there are many large global IT companies, but because there are many companies that are competing with Korean IT companies. In addition, if domestic companies were pushed out of competition, in the past, if there was only a means to give up investment in the stock, now it is possible to achieve new profits through investment in competing Taiwanese companies. Domestic stock investors have already studied a lot about IT companies. If you only add applications to Taiwanese companies, you will be able to experience a much wider investment pool without much effort. It will be a good investment strategy to use it as an opportunity to generate new revenue through interest in Taiwanese IT companies from the new year.

Ⓒ Hankyung.com prohibits unauthorized reproduction and redistribution