|

[뉴욕=이데일리 김정남 특파원] The US New York stock market is falling sharply. As government bond yields soar, not only technology stocks but also economically sensitive stocks and small and medium-sized stocks are panicking at once.

According to market points on the 5th (local time), as of 11:38 am on the day, the Nasdaq index, which is centered on technology stocks, is trading at 10,2498.53, a drop of 1.77% compared to the previous trading day. The Nasdaq Index has already turned downward in that it began trading at 12,888.28 this year. Technology stocks, who have been benefiting from low interest rates, are the first to be hit by the soaring government bond rates.

The Dow Jones 30 Industrial Average fell 0.17% to 3871.98. The Standard & Poor’s (S&P) 500 index fell 0.56% to 3747.52.

It is worth noting that the Russell 2000 Index, which has been focused on small and mid-cap stocks, has also been unable to avoid a downtrend. It is currently trading at 2097.26, down 2.31%. The bear market in the Nasdaq-centered stock market is spreading in all directions.

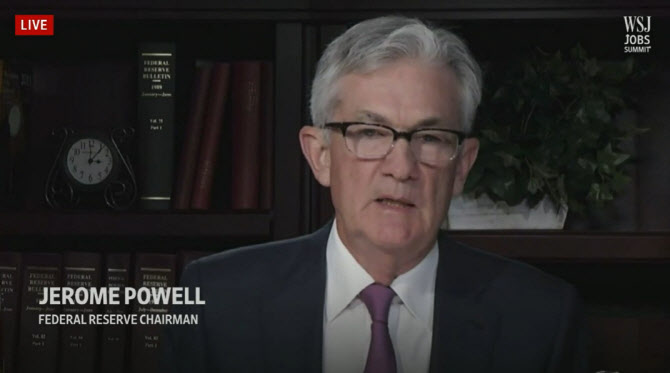

Treasury bond yields are soaring on this day. The day before, the Fed Chairman Jerome Powell made a statement that seemed to actually open the top of interest rates, soaring to 1.626% during the intraday. It’s a surge over tantra (seizure) last week.

Even though the news of strong employment indicators, which broke market expectations, has been heard on the day, the stock market is in a state of keeping an eye on government bond yields. According to the U.S. Department of Labor, non-agricultural jobs increased by 379,000 last month. It significantly exceeded the expert forecast (increase of 210,000 units) compiled by Dow Jones.

Blacksmith Apple is trading at $118.44 per share, down 1.41%. Many other big tech stocks are facing a decline. Boeing shares fell 2.95% to $217.65. Major economically sensitive stocks such as airline stocks and financial stocks are also sluggish.

However, only energy stocks such as Chevron and Exxon Mobil are soaring as international oil prices rise. West Texas crude oil (WTI) for April deliveries jumped more than 3% during the intraday, approaching $66 per barrel.