It was the large-cap stocks with the highest market capitalization including semiconductors that raised the KOSPI to 2700. Foreigners who returned last month focused on buying these stocks. Recently, foreign trading patterns have changed completely. It is also an atmosphere of shifting initiatives. This is because foreigners are focusing on individual stocks with issues. Foreign buying is flowing into eco-friendly stocks that have been neglected for a while and economically sensitive stocks where the industry is recovering.

Illustration = Reporter Chu Deok-young [email protected]

On the 23rd, the KOSPI ended at 2759.82, up 0.96%. Recently, as an analysis that the KOSPI has overheated in the short term, it is drawing a box at the 2700 line. As Corona 19 re-proliferates and the won-dollar exchange rate re-enters the 1,100 won range, more investors are taking profit.

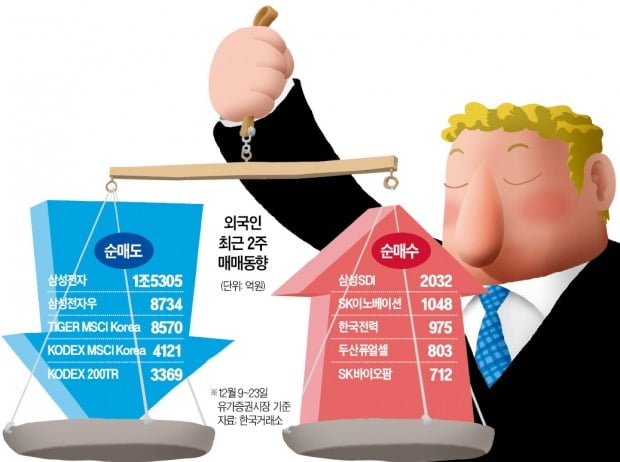

Foreigners, who were aggressively buying Korean stocks on the back of the weak dollar, net sold 2.5 trillion won worth in the last two weeks in the stock market. Among them, Samsung Electronics (including preferred stocks) sold 2,043.9 billion won worth. Samsung Electronics is the stock that foreigners bought the most last month. Noh Geun-chang, head of Hyundai Motor Securities Research Center, analyzed, “As semiconductors soared for a short period of time, foreigners seem to have realized some profits.”

They also sold a large number of listed index securities (ETF), which fueled the large-cap rally. TIGER MSCI Korea (85.71 billion won), KODEX MSCI Korea (4122 billion won), and KODEX 200TR (337.7 billion won) were on top of the net selling list. The KODEX leverage, which moves twice as much as the KOSPI fluctuation rate, also sold 74.6 billion won worth.

Foreigners are showing interest in eco-friendly growth stocks that have been marginalized. Rechargeable battery-related stocks are representative. Over the past two weeks, Samsung SDI ranked first in foreign net purchases, and SK Innovation ranked second.(180,500 -0.82%)Was. It bought two stocks worth 203.2 billion won and 104.8 billion won, respectively. LG Chem’s two stocks surged last month(806,000 +1.13%) It was evaluated as being relatively alienated compared to. LG Chem sold net sales worth KRW 1,713.7 trillion.

Doosan Fuel Cell, which surged until the third quarter of this year and declined in the fourth quarter(55,000 +0.73%)It also bought a net purchase worth 80.3 billion won. Thanks to this, Doosan Fuel Cell’s share price has risen 22.5% over the past two weeks. SK Biopharm was a leader in the industry right after Corona 19, but sluggish in the second half(171,000 -0.87%), CJ CheilJedang(384,500 +1.45%)Also, net purchases worth 71.2 billion won and 47.3 billion won respectively.

They are also buying some of the old blacksmiths that are expected to recover in the industry. KEPCO’s investment sentiment is improving due to the recent introduction of the fuel non-linkage system(26,800 0.00%)This is representative. Foreigners net bought KEPCO worth 97.8 billion won. OCI(82,200 -0.12%)(31.8 billion won), S-OIL(67,700 -2.31%)(31.1 billion won), LG Display(18,250 +6.41%)(18.5 billion won) were also chosen by foreigners.

Market price notice by item

There is also an analysis that the market trend by stock has started with the recent foreign trading trend. On this day, foreigners intensively bought eco-friendly stocks and stocks that are expected to improve next year’s earnings. The number one net purchase on this day was NCsoft, which is scheduled to release a number of new titles in the first quarter of next year.(888,000 +2.66%)Was. It bought a total of 35.2 billion won worth. LG Electronics announces news of establishing a joint venture for EV parts(119,500 ↑29.61%)It also bought 30.2 billion won worth of net purchases.

Pension funds, called the stock market’main gun’, have a similar pattern. They are buying stocks that have a theme or are expected to turn around. In the last two weeks, KEPCO (86.3 billion won) was the number one net purchaser of pension funds. Green Cross, the owner of consignment production of COVID-19 treatment(376,000 -3.09%)(2nd place in net purchase), Samsung Biologics(796,000 -0.87%), SK chemicals(379,000 -1.56%)Also, net purchases worth 64.9 billion won, 38.5 billion won and 24.6 billion won. Samsung C&T has favorable corporate governance reform(137,000 +3.40%)Silver pension fund net purchase was 4th place (42.9 billion won), and Doosan Fuel Cell, the leader of hydrogen energy, ranked 5th (40.5 billion won).

On the other hand, individual investors are selling the stocks net bought by foreigners and institutions. KEPCO ranked first in net selling for the last two weeks. It net sold a total of 239.5 billion won. Samsung C&T, Samsung SDI, and Doosan Fuel Cell ranked second to fourth. In response to this change in foreigners and pension funds trading patterns, analysts say that the stock market landscape is changing from a rising trend to a stock market.

Reporter Park Uimyung [email protected]