Samsung Electronics’ stock price exceeded 80,000 won at one time during the week, breaking the record high again. In the KOSPI market on the 28th, Samsung Electronics finished trading at 78700 won, up 1.16% from the previous trading day. It jumped 73.3% this year alone.

The uptrend at the beginning of the market was unstoppable. It soared to 8,100 won and reached an all-time high. It was 16 trading days after surpassing 70,000 won on the 3rd. Institutional investors net bought 189.5 billion won, leading the stock price to rise, but some of the gains were returned to foreigners’ ‘selling’. On this day, Samsung Electronics’ preferred stock (‘Samsung Electronics Woo’) also closed at 72,900 won, making a new high. Samsung Electronics’ market capitalization, including preferred stocks, reached 530 trillion won.

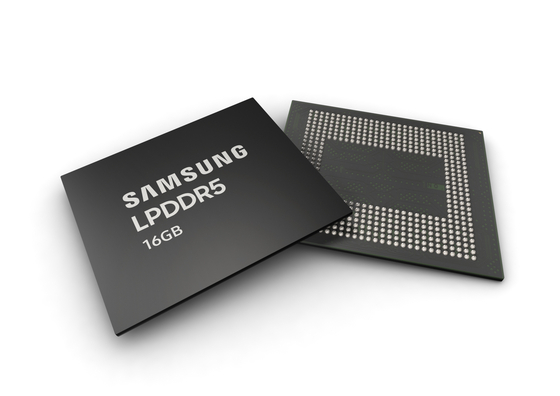

Samsung Electronics’ 1z nano-based 16GB LPDDR5 mobile DRAM. News 1

Ant net purchase of 1.6 trillion won of Samsung Electronics stock in December

The biggest reason Samsung Electronics’ stocks are gaining momentum is the expectation of special dividends. In the market, Samsung Electronics is expected to give special dividends in addition to regular dividends at the end of the year. In 2017, Samsung Electronics announced its plan to “return 50% of the free cash flow (FCF) in 2018-20 to shareholders.” After the death of Samsung Group Chairman Lee Kun-hee, vice-chairman Lee Jae-yong and other owners’ family members are also working to finance the inheritance tax.

Kang Hyun-jung, a researcher at Kyobo Securities, said, “This is the last year of Samsung Electronics’ three-year shareholder return policy, and considering the remaining financial resources, there is a high possibility that the end-of-term dividend will increase.” The total amount of special dividends is estimated to be around 6 to 8 trillion won, around 1,000 won per share. Since the ex-dividend date (the day when the right to receive dividends disappears) in December of this year is the 29th, you must buy stocks by the 28th to receive dividends.

For this reason, in particular, individuals swept away Samsung Electronics stocks early. According to the Korea Exchange, individual investors net bought shares of Samsung Electronics for 1,654.6 billion won this month. Samsung Electronics’ preferred stocks, which can receive more dividends than common stocks, bought 1,998.9 billion won.

Samsung Electronics’ stock price soaring. Graphic = Reporter Kim Kyung-jin [email protected]

KOSPI’s highest price renewed

Expectations for dividends are not the only attractive point for Samsung Electronics. Expectations for the semiconductor super cycle (long-term boom) and strong earnings forecast also played a part. According to DRAMeXchange, the spot price for PC DRAM (based on DDR4 8Gb), a leading indicator of the memory semiconductor industry, was 3.45 dollars on the 25th, up 27% from the end of last month. The outlook that Samsung Electronics’ foundry (consigned semiconductor production) division will grow is also reflected in the share price.

Ji-hye Moon, a researcher at Shinyoung Securities, said, “The foundry industry is expected to improve earnings thanks to structural growth and smartphone sales.” According to F&Guide, a financial information company, the average forecast of Samsung Electronics’ next year’s operating profit (consolidated basis) that a securities company expects is 46.56 trillion won. This is a 26% increase from this year’s estimate.

Reflecting this, securities companies are raising their target price. Shinyoung Securities and Eugene Investment & Securities, which published related reports on the same day, raised their target prices for Samsung Electronics to 87,000 won and 86,000 won, respectively.

In response to the advancement of the stock market’large market stock’, the KOSPI also revised its record high. On this day, KOSPI closed the market at 2808.6, a 0.06% increase from the previous trading day thanks to the institution’s’lion’ (850 billion won). The previous high (2806.86), which was set on the 24th, was rewritten in one trading day. At one time during the week, it climbed to 2834.59, exceeding 2840 units, but in the afternoon, as profit-taking sales of individual investors (net sales of 9300 billion won) poured out, most of the uprisings were returned.

Reporter Hwang Eui-young [email protected]