Input 2021.01.27 14:00

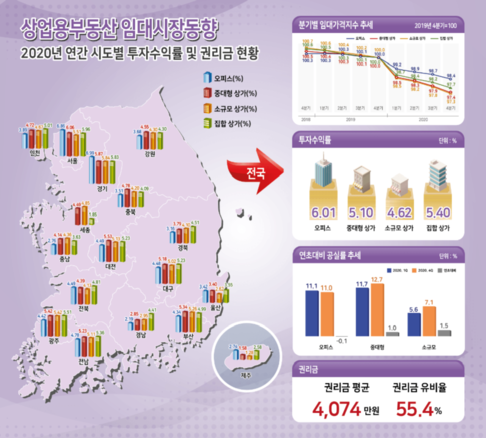

The vacancy rate for small-scale shopping centers (less than 2 stories and less than 330㎡) was also the worst in history at 5.6%, up 1.5%p from the beginning of the year. However, the office vacancy rate was 11.0%, down 0.1%P from the beginning of the year.

The Korea Real Estate Agency said, “Amidst the year-round slump, the vacancy rate increased mainly due to the sluggish business centered on multi-use facilities. On the other hand, offices showed a stable overall demand compared to shopping centers, and the demand for shared offices also increased.” Revealed.

The rental price index, which represents market rent fluctuations, has fallen sharply across all commercial property types. As vacancy increased and sales decreased, the rental price index of small and medium-sized shopping centers fell 2.71% and 2.63%, respectively, compared to the previous year, and the level of rent for collective shopping centers also fell 2.27% compared to the previous year. The office rental price index fell 1.6% year-on-year due to a decrease in demand for old offices and an increase in rental free.

By region, Seoul made the best performance in offices, mid- to large-sized shopping centers, and multi-storey shopping centers, with its rental price index lower than the national average, but the small-scale shopping center rental price index fell by 3.37% compared to the previous year, which was a big hit. In the first quarter of last year, due to the impact of the corona19 group infection, Daegu showed the nation’s largest decline in all types of shopping centers, including medium-sized shopping centers (-4.16%), small shopping centers (-4.11%), and collective shopping centers (-5.12%).

Last year, the return on investment of commercial real estate appeared in the 4-6% range, which was higher than other investment products. The low interest rate, increased liquidity in the market, and strengthened housing market regulations resulted in the inflow of investment funds into the commercial real estate market, resulting in an increase in asset value.

However, the rise in asset value slowed compared to the previous year, and the return on investment in all types fell from the previous year due to the decline in rental income. Compared to 2019, the return on investment in commercial real estate in 2020 was △Office 7.67%→6.01% △Mid-large shopping mall 6.29%→5.10% △Small shopping mall 5.56%→4.62% △Combined shopping mall 6.59%→5.40%.

By region, Seoul and Gyeonggi showed a 6% return on investment in offices, while Gyeongnam, Jeju, and Chungnam showed poor returns of around 2-3%. As for the shopping district, Seoul, Gyeonggi, and Gwangju showed high levels of 5% or more in all types, while Jeju showed low levels of 1~3% in all types.

With the rapid increase in business closures due to Corona 19, the proportion of malls with rights deposits has decreased significantly. Last year, the ratio of rights to shopping malls nationwide was 55.4%, down 12 percentage points from the previous year. The average level of rights fees also fell 4.7% from the previous year to 4,074 million won.