Last year, the size of IPO increased significantly compared to the previous year due to the listing of large companies such as Big Hit and SK Biopharm.

Interest in public offering stocks also surged, and the average subscription competition rate doubled.

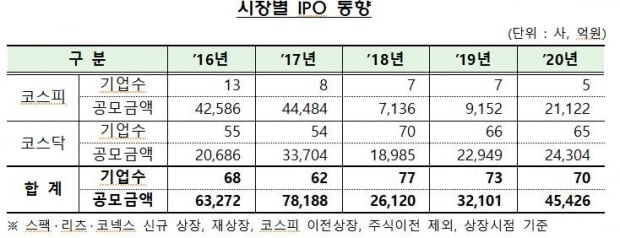

According to the Financial Supervisory Service on the 18th, last year’s IPO companies (excluding new listings and re-listing of SPEC, REITs, and KONEX) totaled 70, a slight decrease from the previous year (73). Increased by 40.6%.

Big Hit, SK Biopharm, Kakao Games, and other’invited language’ companies entered the stock market one after another.

As general investors’ interest in public offering stocks increased, competition for subscription was overheated.

The average subscription competition rate of general investors was 956 to 1, about twice that of the previous year (509 to 1).

As a result of the subscription to the general public offering of Iruda, a skin care device developer, the competition rate reached a record high of 3,39:1.

The competition rate for demand forecasting of institutional investors also increased.

Due to intensifying competition for demand forecasting, the proportion of the offering price determined above the top of the band reached 80%.

Institutional investors’ commitment to hold also increased.

Institutional investors who have invested in almost all listed companies have committed to mandatory holding for a certain period of time, and the ratio of mandatory holding commitments (average 19.5%) in the amount allocated to institutional investors slightly increased compared to the previous year (16.5%).

In the KOSDAQ market, listing of venture companies using a special case system that does not generate profits or allows them to be listed without an evaluation rating from a technology evaluation agency was prominent.

The proportion of special cases for technology evaluation (60.7%), centered on the bio industry, such as medical devices and treatments, was high.

The Financial Supervisory Service announced that it will induce enhancement of the securities report so that investors can obtain sufficient information to determine investment in public offerings.

In addition, the fact that even if the offering price is determined above the top, does not guarantee high returns after listing, and that specially listed companies can be listed even if they are in the red, so that profits may not be generated within a short period of time.

As the allocation method of public offering shares to general subscribers has changed, he asked to confirm the subscription and allocation method (batch, separate, multiple, etc.).

/yunhap news

Ⓒ Hankyung.com prohibits unauthorized reproduction and redistribution